Let us learn how to apply for quick loans in co-operative bank Kenya. Many people in Kenya, both salaried and non-salaried, have different needs in life. Some of these needs tend to be urgent and require swift action, while others seem to need slow action.

Kenyans seek money in different places. Individuals with bank accounts take salary advances and loans from banks and pay back after they get paid.

This is therefore why Co-operative Bank of Kenya understands this and has therefore made provision for loans for various needs of Kenyans.

About Co-operative bank loan

The Co-operative Bank of Kenya is a publicly listed bank, aiming to be Kenya’s foremost bank with a strong national presence. Incorporated under the Company Act in 1965 and also licensed to carry out banking business under the Banking Act in Kenya.

Subsequently, companies of Co-operative bank Kenya runs three subsidiary companies, namely:

- kingdom securities limited: a stockbroker with a 60% controlling stake in the bank.

- The bank owns the fund management subsidiary Co-opTrust Investment Services Limited.

- Co-op Consultancy & Insurance Agency Limited (CCIA): A subsidiary wholly owned by the bank that specializes in corporate finance, financial advisory, and capacity building.

How do I qualify for a co-operative bank loan Kenya?

- 18years and above

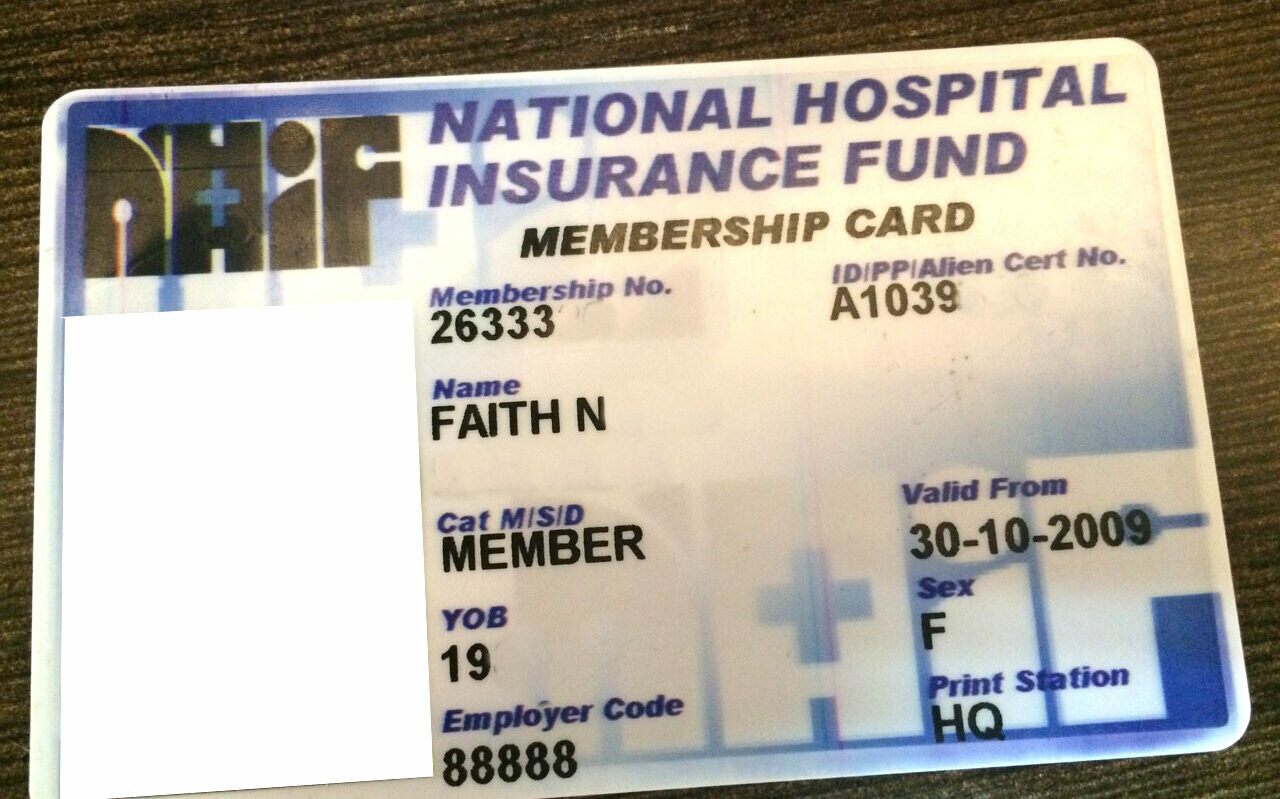

- Original National Identity Card

- Original KRA PIN Certificate

- Salary pay slips for the last 3 months.

- Filled loan application form.

How to apply for co-operative bank Kenya loan

To apply for co-operative bank loan, check round their website and download the form. You can also visit their physical branch and have then guide you on loan application

Loans offered by the Cooperative Bank of Kenya

Loans offered by co-operative bank of Kenya are:

- Personal loans

- Bizwise SME loans

- Co-op bank Flexi loan (salary Advance)

- Insurance finance loans

Personal loans

Personal loans offered by Co-operatives have been designed with features that facilitate the purchase of specific goods and services. In this regard, customers can get a Co-operative Personal Loan to buy shares on the NSE, to Top-up their loan balance to the original amount. To also finance the expansion of dairy production for dairy farmers or even for Sacco to on-lend to members.

Enhanced Benefits:

- The Maximum borrowing limit for unsecured loan raised to Ksh. 3 million.

- Maximum repayment period extended from 36 months to 60 months for loan amounts above Ksh. 100,000

Features:

- Minimum loan amount of Ksh 50,000

- Maximum loan amount of Ksh 4,000,000

- Maximum term of 72 months

- The purpose of the insurance policy includes education, medical, furniture, consumer durables, motor vehicles, plot purchase, holidays and shares.

- Credit scoring serving as a determinant for the appraised value of applications.

- Applications approved within 48hours.

Business/Bizwise SME loan

They provide small and new businesses the funding they need to grow. Small business owners can apply for the loan and the rates are affordable.

Their business expansion loan enables you to open new branches and launch new products. You can also finance the purchase of equipment, and purchase assets like land, buildings, and motor vehicles. The Bizwise SME loan can be up to 50 million.

Requirements:

- Need the applicant to have operated a business current account in Co-op bank for at least 6 months.

- Provide the bank with bank statements

- Business Registration documents such as a Certificate of incorporation, Memorandum e.t.c.

Co-op Bank Flexi Loan (Salary Advance)

Don’t worry about surviving a tough month with Co-op Bank. Co-op Flexi Cash lets you borrow between Kshs 3000 and 100,000 for emergencies or short-term expenses.

This product has an interest rate of 1.16% and is repayable for not more than three months. The Co-op Flexi Cash has no additional security requirements. And, if you apply through MCo-op Cash, you will not incur any facilitation fees. You must have an active salary account with the bank for at least six months to qualify for Flexi Cash.

Insurance Finance Loan

This loan is given to people with insurance policies who need to pay their monthly premiums. Essentially, a lump-sum premium payment is made to the insurer on your behalf by the bank leaving you to pay the loan back in simple monthly installments at very competitive interest rates. The bank also offers flexible repayment options between 4 months and 10 months.

Benefits:

- The benefit of the loan is that it was tailored to fit the individual cash flow needs.

- Funds are freed up, giving you the liquidity you desire.

- Quick approval and simple application process, and no security required.

- The minimum amount to be financed is Ksh 15,000 and there is no maximum.

- Anyone can apply, and almost any insurance finance policy is covered.

How to apply for Co-operative insurance Finance loan

You can apply at any Co-op bank branch countrywide or through your insurance broker.

The Co-op mobile banking App

Co-operative is banking on the mobile service to grow earnings from transaction charges. M-Co-op Cash charges a one-off seven per cent fee for secured personal loans between Sh100,000 and Sh200,000 repayable within 30 days.

Features of the app

- Apply for a loan

- Send money to other mobile money services, for example, M-PESA.

- More than 100k downloads

Co-operative bank loan Calculator

The Cooperative Bank of Kenya loan calculator is available online to customers, and helps them calculate the total cost of the loan, the start and completion dates as well as the monthly installments. With a customized calculator, you can choose your repayment period and monthly installment for each loan type.

How to repay your co-operative bank loan

You can repay by funding your account and having the money automatically deducted

Or

By visiting the bank and asking for a different option.

How long does it take to process a loan in a co-operative bank?

The duration of the Co-operative bank loan usually depends on the type of loan one wishes, such as personal loans, business loans, SME loans, and others. Most loans are approved within 24 business hours.

Conclusion

In Kenya, Co-operative banks are offering guaranteed loan approval all over the county. They are very different from the banks or those finance agencies where the loan applicants have to struggle a lot to borrow money.

Their application procedure is so simple and straightforward. Borrowers are free from documentation hassle.

Co-operative bank has a team of loan experts and insurance finance brokers who have immense experiences in helping people out from their financial emergency.