Loans aren’t always a bad idea if you go about it right. Technology has revolutionized loans, making them accessible with a few taps on your phone. Our goal is to educate you on loan application and agreement forms and how to write a simple loan agreement.

What is a Loan Agreement?

Informally, a loan agreement is a contract between two parties – a lender and a borrower defining the conditions of the loan. In the event that one of the parties fails to fulfill their obligations, the other party may enforce the loan conditions in court.

In return, the borrower promises to repay the lender the loan at a later date, possibly with interest. Moreover, the lender cannot suddenly decide not to lend money to the borrower, especially if the borrower made a purchase with the expectation of receiving money soon from the lender.

What is a Loan Agreement Form

A Loan Agreement is a document that is signed between two parties that want to get into a transaction involving a Loan. The loan agreement document is signed by a Lender (the individual or company giving the loan) and a Borrower (the individual or company receiving the loan).

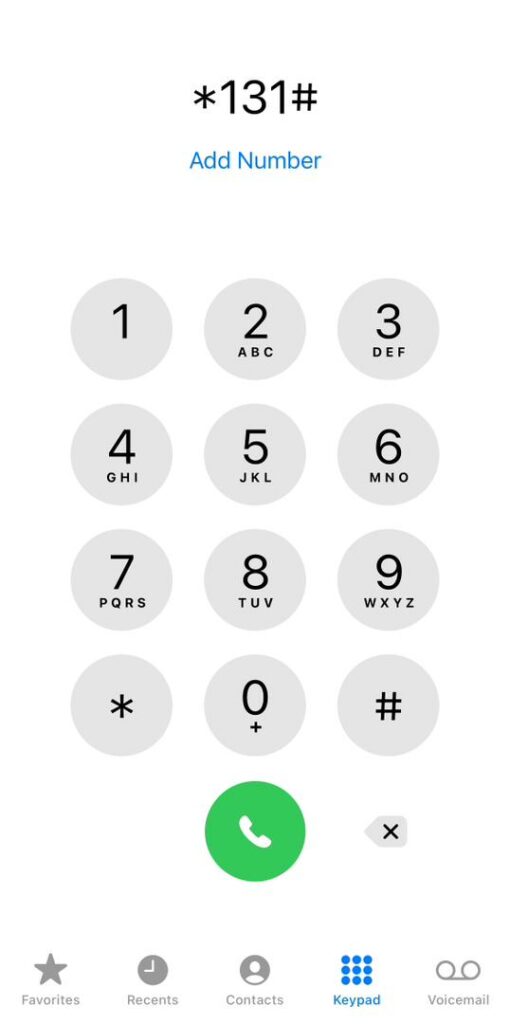

Loan application

A loan application is a procedure for obtaining a loan. Applicants for a loan use loan applications to request financing. Borrowers reveal key information in their loan applications. An application for a loan is critical to determining whether the lender will approve the loan or not.

What should be included in a loan agreement?

- Details of the borrower

- About the lender

- Loan amount

- Interest rate

- Repayment date and duration

- Collateral

- Late charges

- Other fees like origination fees, legal fees, insurance fees, etc.

- Prepayment for a discount

- Governing law in case there is a problem with the agreement

Personal Loan Agreement form template

The loan agreement sample below details an agreement between a borrower and a lender. The lender agrees to give the borrower a loan, who agrees to pay back the loan according to the conditions specified.

How do I write a simple loan agreement?

Here are 6 easy steps to writing a personal loan agreement:

- In starting the Document, write the date at the top of the page.

- Write the terms of the Loan and state the purpose of the personal payment agreement and the terms for returning the money.

- Date the Document of Agreement

- Sign the Document

- Record the Document

Who Needs a Loan Agreement?

- Borrower

- Buyer of a home

- Buyer of a car

- Seller of a home or a car

- Investors

- Business men

- Family members

When To Use a Loan Agreement Form

Often, relying on only a verbal promise can result in one person falling short. A written agreement can specify a loan’s terms and the amount of interest owed by the borrower.

Here are some situations where you may need a Loan Agreement:

- Starting a business and need a capital loan

- Purchasing land or a home with a real estate loan

- Investing in a higher education or repaying a student loan

- Buying a new car or boat for personal reasons

- An employee loans from their employer

- Helping a friend or family out with a personal loan

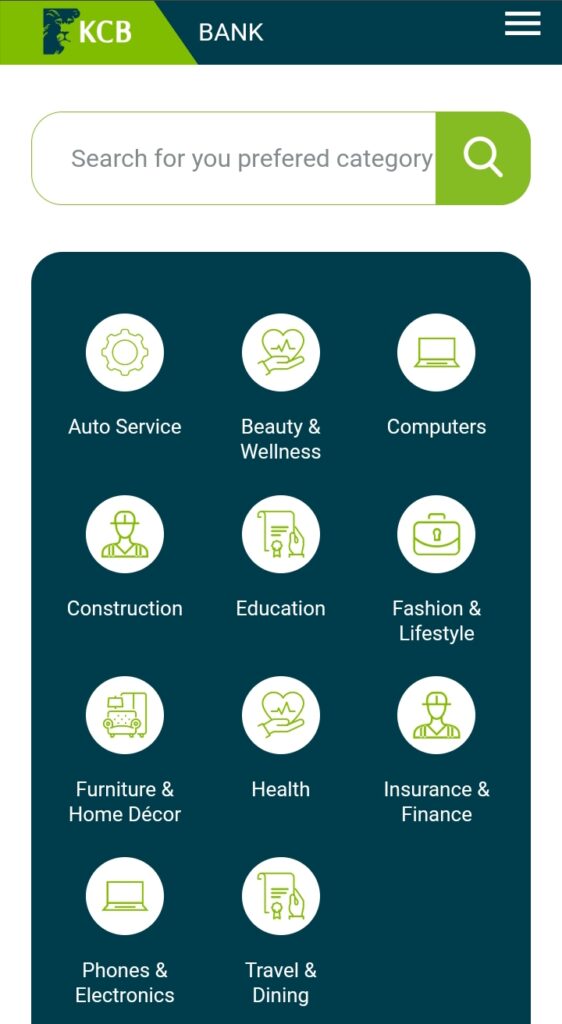

Sample loan agreement in Kenya

The loan agreement template in Kenya addresses the following details:

- Who: The borrower and the lender, or the person taking money and the person giving money

- What: The amount of money or “principal” that is being borrowed, and whether interest or a percentage of the principal is also owed

- When: The duration of the loan or date the principal and any interest should be repaid back to the lender.

Conclusion

Borrowing money could be one of the best decisions you ever make. Those trying to apply for a loan often do not know how to go about it. In contrast to traditional loan applications at banks that take a lot of time and are filled with procedures, online applications are far easier. Find out how to write a loan agreement, how to complete a loan application, and when to use a loan agreement form. With all these, you are good to go.