Instant loan apps in Kenya have emerged as a game-changer for borrowers seeking quick and convenient access to loans. With your smartphone and the internet, you can download these instant loan apps in Kenya from the Google Play Store or Apple Store.

They offer a lifeline in times of emergencies, bypassing the traditional, often cumbersome, loan application processes of conventional banks.

This article explores the top 10 instant loan apps in Kenya, renowned for their quick processing times, good features, easy eligibility, low rates, good reviews, and user-friendly interfaces.

Top 10 Loan Apps in Kenya

| Name of Loan Apps | Features | Eligibility criteria | Interest rates | User reviews and ratings |

| Saida Loan App | Easy to access Minimum of ksh 600 to ksh. 100000 Repayment period of 30 days. Requires a good credit history. Easy application. | From 18 years to 65 years as a Valid M-pesa number Has a valid national ID Good credit history | 7.5% to 10% | More than 500k downloads More than 20,182 reviews Over 4.0/5 rating Requires 5.9 memory Capacity |

| Shika Loan App | Easy to access Minimum of ksh 500 to ksh. 20000 Repayment period of 30 days. Charges late repayment fees Requires a good credit history. Easy application. | From 18 years to 65 years Has a Valid M-pesa number Have a good M-Pesa history. Has a valid national ID Good credit history | 15% | More than five million downloads More than 50,110 reviews Over 4.5/5 rating |

| Opesa Loan App | Easy to access Minimum of ksh 500 to ksh. 3000 Repayment period of 30 days. Requires a good credit history. Easy application. | From 18 years to 65 years Has a Valid M-pesa number Has a valid national ID Good credit history | The interest rate depends on the loan amount. | The interest rate depends on Loan amount. |

| Haraka Loan App | Easy to access Minimum of ksh 500 to ksh. 5000 Repayment period of 30 days. Requires a good credit history. Easy application. | From 18 years to 60 years Has a Valid M-pesa number. Have a good M-Pesa history. Has a valid national ID Good credit history | 23% | More than one million downloads More than 10,000 reviews Over 4.0/5 rating |

| Timiza Loan App | Easy to access Minimum of ksh 500 to ksh. 150000 Repayment period of 30 days. Requires a good credit history. Easy application. | From 18 years to 65 years Has a Valid M-pesa number Has a valid National ID Good credit history | 6.17% | More than one million downloads More than 5,00 reviews Over 4.0/5 rating |

| Branch Loan App | Easy to access Minimum of ksh 350 to ksh. 50000 Repayment period of 30 days. Requires a good credit history. Easy application. | From 18 years to 65 years Need a Facebook account Has a Valid Safaricom number Has a valid National ID Good credit history | Interest rates depends on the amount of Loan applied | More than ten million downloads More than 400,000 reviews Over 4.5/5 rating |

| Tala Loan App | Easy to access Minimum of ksh 500 to ksh. 50000 Repayment period of 7 days and 30 days. Repay using a paybill number Requires a good credit history. Easy application. | From 18 years to 65 years Has a Valid M-pesa number Has a valid national ID Good credit history | 15% | Interest rates depend on the amount of Loan applied |

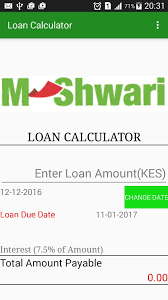

| M-shwari Loan App | Easy access to funds. Must be an active user of M-pesa for 6 months. Read data on your phone after installation. Minimum of ksh 500 to ksh.100000 Repayment period of 30 days. Requires a good credit history. Easy application. | From 18 years to 60 years Has a Valid Safaricom number Has a valid national ID Good credit history | 7.5% | More than one million downloads More than 50,182 reviews Over 4.6/5 rating |

| KCB M-Pesa Loan App | Easy to access Minimum of ksh 50 to ksh.1000000 More Loan limits open as you borrow and repay on time. Repayment period of 30 days. Requires a good credit history. Easy application. | From 18 years to 60 years Has a Valid Safaricom number Has a valid national ID Good credit history | 3.6% | More than one million downloads More than 40,182 reviews Over 4.5/5 rating |

| iPesa Loan App | Easy to access Minimum of ksh 500 to ksh. 50000 Repayment period of 7 days and 30 days. Repay using a pay bill number Requires a good credit history. Easy application. | From 18 years to 65 years Has a Valid M-pesa number Has a valid national ID Good credit history | The interest rate depends on the Loan amount. | 6% and a service fee of 5% to 10%. |

Factors to Consider When Choosing a Loan App

Before choosing any loan app in Kenya, check out for these factors,

- Interest rate

- Loan limits

- Approval speed/time

- Repayments terms

- Penalty fees

- Additional fees or charges

- Customer reviews

- Privacy and security

- Regulations

Tips For Responsible Borrowing

The eight major tips for responsible borrowing are:

- Borrow only what you need

- Consider your income

- Understand the loan terms

- Avoid multiple loans

- Plan Repayments

- Borrow only during emergencies

- Read reviews to see what you are going into

- Plan to repay on time.

Conclusion

The digital revolution in Kenya’s financial market has made accessing loans faster and more convenient than ever before through instant loan apps.

The top 10 instant loan apps in Kenya, highlighted in this article are the best, offering financial solutions tailored to meet the immediate needs of their customers.

While these instant loan apps in Kenya provide quick relief in times of emergencies, borrowers are encouraged to use them wisely, considering the terms and interest rates to ensure they maintain healthy financial habits.