Safaricom offers users a means of borrowing credit and paying it back later as they top up, more like a bank overdraft on their airtime, but at a small fee. How does this work? Let us learn about how to borrow airtime from Safaricom line.

About Safaricom Kenya

Safaricom PLC is a Kenyan mobile network operator headquartered in Nairobi, Kenya. Founded in 1997, it is the largest telecommunications provider in Kenya and one of the top 10 most profitable companies in the country.

There are five mobile telecommunication services offered by Safaricom – Simu ya jamii, M-PESA, Prepaid and Postpaid, Business and Enterprise, International Roaming, and Data and Messaging. But Safaricom’s M-PESA application is mostly used and it allows users to transfer money using their mobile phones.

Moreso, in the Data and messaging section, Safaricom provides instant airtime to users through Okoa Jahazi. You can repay later the airtime when you top up.

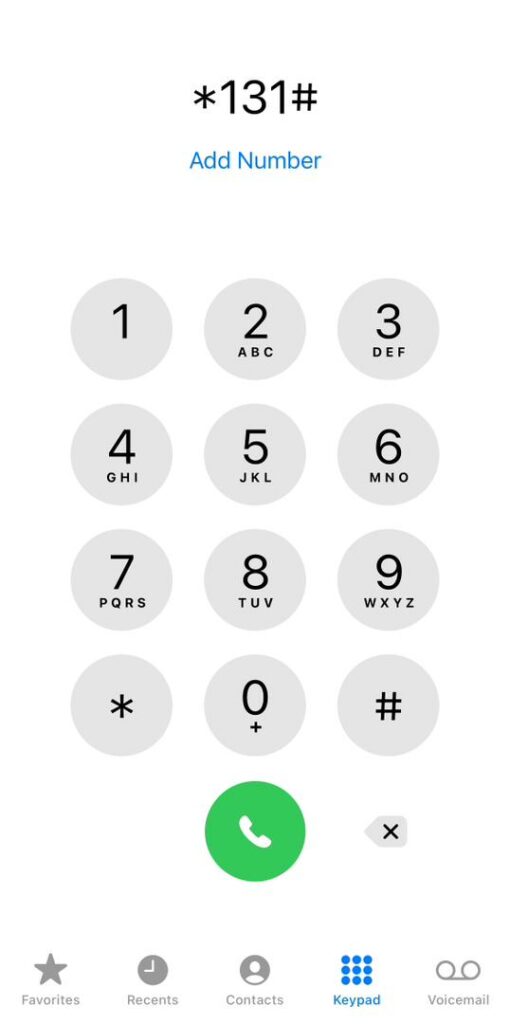

Okoa Jahazi Code

Eligible individuals or subscribers who meet the requirements can dial *131# or *456*2#, then choose “Auto-Okoa” and select “Subscribe” and choose the amount of Okoa Jahazi loan you want to borrow.

About Safaricom’s Okoa Jahazi Service

This is a service platform where Safaricom PrePay subscribers can borrow airtime when they request it. Services of Safaricom’s Okoa Jahazi:

- Subscribers who meet the eligibility criteria can request an advance of mobile airtime using the Okoa Jahazi service.

- Credit Advances are credited to their PrePay accounts after they deduct their service charges.

- Safaricom charges an advance fee of 10% for each Credit Advance that you request.

Eligibility For Safaricom’s Okoa Jahazi Airtime Advance

You must meet a few criteria before you can borrow Safaricom airtime, some of which are listed below:

- Sign up for the Safaricom PrePay service.

- In order to qualify for the Credit Advance, you must have spent airtime equivalent to the amount requested for the last seven (7) days.

- Your account balance must be less than Ksh 2.

- Be able to top up over 180 days in order to maintain an active line.

How to Borrow Airtime From Safaricom Line

You can request credit advances by completing the following steps:

- By dialing *131#, you will receive a confirmation SMS message which confirms you have received the credit advance.

- They cannot cancel once they have submitted credit advance requests.

- Tracking your Credit Advance usage is possible by dialling *144*4# and sending an SMS to 144.

Rates For Service Charge on Safaricom Line

| AMOUNT REQUESTED FOR | SERVICE CHARGE | AIRTIME CREDITED |

| 1000 | 100 | 900 |

| 500 | 50 | 450 |

| 250 | 25 | 225 |

| 100 | 10 | 90 |

| 50 | 5 | 45 |

| 20 | 2 | 18 |

| 10 | 1 | 9 |

Conclusion

If you have fully repaid your previous credit advance, you can request the credit advance every day. Kenya’s Safaricom is the largest and strongest communications company in the country. It offers several services, including M-PESA, the famous mobile money service.

They offer a platform where you can borrow and pay back airtime. We advise you to read the terms and conditions of these borrowing services in Kenya before getting involved.

Read Also: Where to lease your car in Kenya