Lenders and borrowers continue to rise as nearly every sector and individual struggles with insufficient funds to deal with their daily transactions. Getting loans in Kenya is feasible and easy. It gets easier when you face multiple alternatives to select from.

Considering this factor, loans in Kenya have really come in handy. What’s more good about it is that it can be gotten within minutes after filling the application form.

Technology and innovative digital services in Kenya made everything so simple. With all these in mind, let us discuss loans in Kenya.

About Loans in Kenya

Kenyans can get loans from a variety of sources, including mobile phone apps, banks, mobile network providers, and credit cooperative organizations (SACCOs).

There are now more than 40lending platforms in Kenya, and new services keep launching. Likewise, the hype is growing about the possibilities these products offer, from increased household liquidity to small business loans for entrepreneurs.

Many users value the convenience and speed of accessing a loan via their phone, as well as their bank. New borrowers and lenders rise because of this rapid proliferation.

How Do I Apply For a Loan

There are many ways you can apply for loans in Kenya. You can apply through the bank, credit union, loan apps, etc. Then to apply:

- Simple begin by visiting the bank or the lender or downloading the loan app

- Fill the application form

- Register and submit all relevant documents

- After successful registration, apply for the loan.

- Choose the loan amount and repayment term

- Wait for approval. Once approved, get your loan.

Who Borrows And Why

Loans have benefited many people who would otherwise have remained financially bankrupt. The individuals eligible to borrow include:

- The poor

- Men

- Youths (18years and above)

- Business individuals and

- Women.

- All citizens of Kenya from 18years to 68years.

Furthermore, individuals borrow for different purposes which could be:

- To fund or expand a business

- Buy or purchase a car

- Offset a debt

- To pay for school fees

- To buy a house and various other reasons.

5 Documents For Loan Applications

To start a loan application in Kenya, there are documents you need to possess before you can qualify for a loan. These documents include:

- National ID or passport proving identity

- Pay slip

- Account statement

- Passport

- KRA pin

Rates And Fees Associated With Loans in Kenya

Digital borrowers in Kenya are meant to pay up some fees when taking up a loan. The fees are often to allow the lender to allow you to keep his or her for a period. The fees associated with loans in Kenya are:

- Interest rate

- Negotiation fee

- Application or processing fee

- Origination fee

- Appraisal fee

- Late repayment fee

What Determines How Much Interest You Will Pay on a Loan

Lenders use a lot of factors to determine interest rates. Risk is a key factor that lenders consider when making decisions. While some prefer very little exposure to it, others are more tolerant.

One thing is for sure: a risky investment will cost you more. Here are some ways lenders measures the risk of investing in you loan you applied for:

- A high credit score reduces the interest rate

- Secured loan lowers the rate

- Short loan duration brings down the rate

- Size of the loan amount impacts your rate

- Reasons for borrowing can also affect the amount of the interest rate to pay

How Can I Get Loans in Kenya

To get loans in Kenya, follow the procedure:

- After all due processes and submission of documents and application

- Submit your account details or M-Pesa account details

- Check your account for the fund.

10 Banks That Offer Loans in Kenya

The list if banks that offer loans in Kenya are:

- KCB group

- Musoni microfinance bank

- Absa bank Kenya

- Family bank

- HF bank

- National bank

- Ecobank

- Standard chartered bank Kenya

- Equity bank

- Sidian bank

- Stanbic bank

- Bank of Africa

8 Loan Apps in Kenya

The list of 8 loan apps in Kenya are:

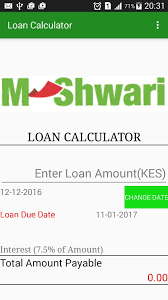

- Mshwari

- KCB M-Pesa

- Tala

- Branch loan

- Okash

- Timi

10 Banks That Offer Loans in Kenya

The list if banks that offer loans in Kenya are:

- KCB group

- Musoni microfinance bank

- Absa bank Kenya

- Family bank

- HF bank

- National bank

- Ecobank

- Standard Chartered Bank Kenya

- Equity bank

- Sidian Bank

- Stanbic Bank

- Bank of Africa

8 Loan Apps in Kenya

The list of 8 loan apps in Kenya are:

- Mshwari

- KCB M-Pesa

- Tala

- Branch loan

- Okash

- Timiza

- Shika

- Haraka

Conclusion

In recent years, many in the financial sector supported loan applications because they saw that loans could be used by unbanked or under-banked customers to meet their needs.

In loan application, the amount you borrowed, and the interest accrued will be the two largest chunks of the payments you will make, but they are not the only ones.

As with loans in Kenya, do your homework and be informed to make the best decision. You read this article, so you’re well on your way!