National Bank of Kenya is the latest and only full-service multinational bank in Kenya, combining local and international expertise with a large private-sector presence. They provide a financial cornerstone for the future and opportunities for the present and future generations through various financial loan products and services.

About National Bank of Kenya

National Bank of Kenya (NBK) was established by the National Bank of Kenya Act 1964, as a banking company limited by guarantee, wholly owned by Kenyan citizens and controlled by the Central Bank of Kenya (CBK). The bank is committed to and renowned for making and keeping friends. NBK has grown faster than its peers and grown into a fully subsidiary driven bank with branches in both urban and semi-urban areas in all the provinces driven by well serviced Automated Tellers Machines (ATMs) and customer driven Branch Network. Through their strong relationship driven values we have created thriving businesses at our branch network levels.

National bank of Kenya loan products

NBK has different loan products and they include:

Unsecured Loan

Unsecured loan is an easy loan of up to ksh 6 Million shillings without collateral. You can get the best loan to fund education for your children, go on a shopping e.t.c.

Features:

- Easy accessibility

- Easy payment

- Short processing period

- No collateral

- Loan top up

National Bank of Kenya Mortgage loan

Are you in need of a house? You can set you off on the journey to owning your new home. NBK home loan supports you in the buying of an existing and completed house.

Features:

- You can increase asset

- Opportunity for mortgage relief

- Value in appreciation and increase in property over time.

How to get loan from National bank of Kenya

Do you need a loan from the National Bank of Kenya? Please read on to learn more about this process, and get started today.

- Visit the website

- Go to “Get a loan”

- Choose the type of loan Product you want

- Put all necessary personal information and documents

- Wait for loan approval

National Bank of Kenya app

The national bank of Kenya apps includes:

- Natmobile

- NBK mobile banking- used in accessing various banking services.

- KCB

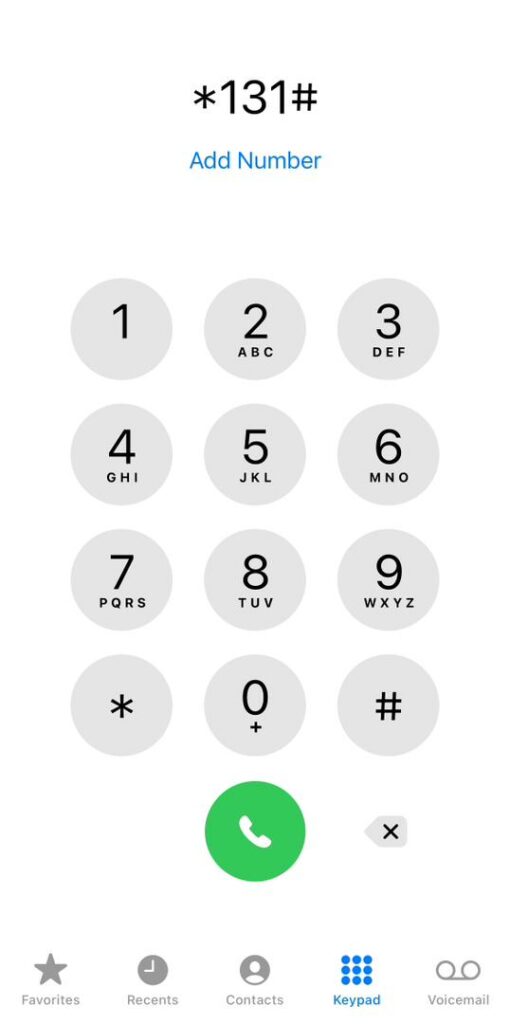

How do I withdraw money from NBK to M-Pesa?

The steps for withdrawing include:

- Locate your phone’s M-PESA menu.

- Select Lipa na M-PESA

- Choose the PayBill option.

- Enter your bank’s business/paybill number

- Type in your bank account number (this is the number of the account you want to send the cash to).

- Input the amount.

- Enter your M-PESA pin.

- Get the confirmation message

National bank of Kenya contacts

You can chat with them via +254 (20) 282 8900, +254 703 088 900, +254 732 118 900.

National Bank Head Office Nairobi

The address for National Bank Kenya Nairobi is at National bank building, Harambee Avenue Nairobi. P.O Box: 72866, Nairobi, 00200

Conclusion

National Bank of Kenya wants you to get the loan that suits your needs! Become a loan customer today and get your money in minutes.

Tip: Crypto loans are fast becoming a thing.