We would be looking into how to qualify for KCB loans in this article. The KCB loan application process is simple and anybody who meets the requirements has already qualified for the loan.

Customers can borrow from KCB for a variety of amounts ranging from ksh.1,000 to Ksh. 1,000,000. Their loans are accessible and affordable. Read along to understand more about this topic.

About KCB Loans Group

KCB Group is a licensed banking institute and a registered non-operating holding company. It started operations in January 1, 2016. The holding company oversees KCB Kenya. KCB Kenya renders financial services to the people.

They have different types of loans that suits various needs. KCB group has regional units in Uganda, Tanzania, Rwanda, Burundi, Ethiopia and South Sudan. It also owns KCB Insurance Agency, KCB Capital, KCB Foundation, National Bank of Kenya and all associate companies.

How Do I Qualify for a KCB Loan?

What KCB needs from you to qualify for the loan include:

- Valid Kenyan ID or passport.

- Recent original Payslips.

- Evidence of source of income for self-employed persons.

- Be an active KCB account holder for a minimum of 6 months

- For credit card advance, possess a KCB financial card

Eligibility to Qualify for KCB Loans

- Be 18years and above

- Have a valid national ID

- Possess a registered sim

How Long Does it Take to Process a KCB Loan?

KCB loans are gotten once you qualify and are done with the application. At most, expect it within 7 working days.

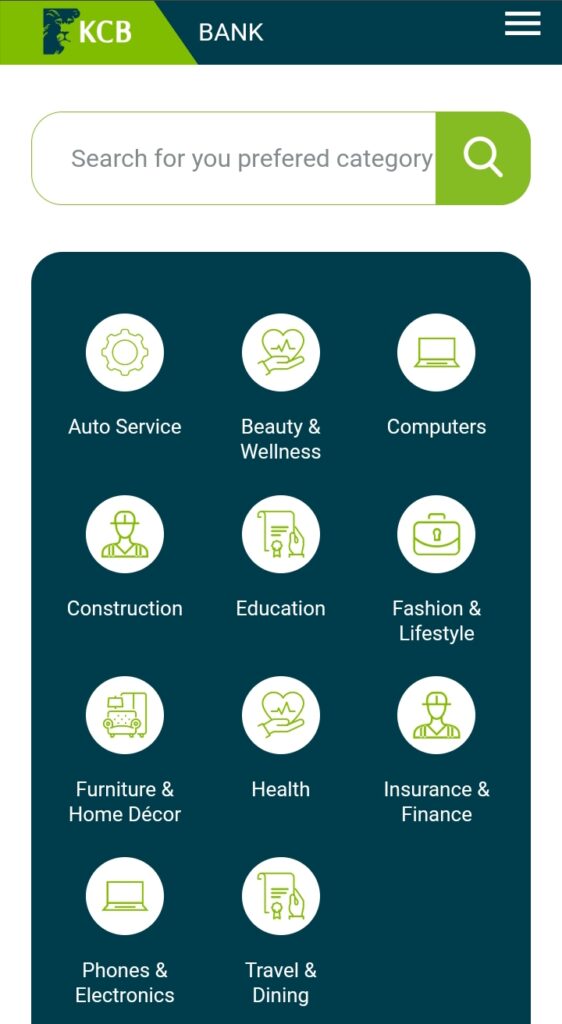

Different Categories of KCB Loans

- Personal secured loans

- Personal mobile loan

- Unsecured checkoff loans

- Emergency loans

- Salary advance

- Business loans

- Sharia Compliant personal loans

How to Apply For KCB Loan

Applying for KCB M-pesa loan is simple. Just follow the steps below:

- Visit the website to apply from there

- Fill all required information

- Get a feedback, apply and Submit all documents if requested for

- Wait for approval, if approved, you get your loan within a few hour

Conclusion

KCB loans are easy to qualify for once you meet all the requirements. It is also very easy to get the loan. Go ahead and apply once you meet the requirements.

There are also different types of loans available. Every loan type serves a purpose for a particular goal. Take advantage of KCB loans and all the features that come with them.