Kenya’s leasing market is dominated on the demand-side by individuals and corporate customers. With varieties of leasing companies, some independent leasing entities, and some affiliate with other companies to lease out their cars.

The central concern here is where you can lease your car to be earning cash in Kenya. In this regard, we will discuss some platforms you can lease your car in Kenya and still keep ownership of the car.

What is car leasing?

Leasing a car is entering a long-term contract for that car. Car leasing in Kenya allows you as the car owner to make monthly income with your car. The leasing company gets the vehicle from the lessor or dealer to individuals willing to use the car, and then they make payment to the leasing company.

The leasing company at the end of the day pays the owner of the car. Lease contracts are commitments that bind parties together till the contract ends. Loan sharks sometimes come in handy.

Pros and cons of car leasing in Kenya

Pros:

- It makes the lessee avoid incurring frequent loans from the bank and has the frequent cash flow to live with.

- It helps in preserving cash for other uses and so may get a higher return

- Provides an opportunity for an individual to use the return for other investments

Cons:

- Issue of breach in contract might come in

- Cars can break down, and insurance cover might now fully cover the whole expenses for the car.

Where can I lease my car in Kenya?

Kenya is filled with individuals who are engaged in one form of different activities or the other. Some who do not owe cars might need cars to attend to their needs. Different places to lease your car in Kenya are:

- Kaka Logistics Enterprises Limited

- ARS Kenya

- Myhire

- Vismart

Kaka Logistics Enterprises Limited

The services of Kaka logistics enterprises match people who want to borrow a car with those people who have a car to lease out. Take your car with all insurance cover to their office and register to earn from Ksh. 25,000 to Ksh.130,000 when the contract has been sealed. They are a logistics enterprise that allows the lessors to lease out their cars when they are not using them.

Procedures and other information

- You enter into a legally binding contract

- Let you know that payment is done on every 5th of a new Month.

- Be informed that you will earn between Ksh. 25,000 – ksh. 150,000 depending on your car

- Your vehicle will be used for leasing services only.

- Be aware that they do general car services.

- Recommendation of private comprehensive insurance requirements.

- The minimum duration for the lease is from 6 months to a maximum of 1 year.

- Acceptance of car alarm/track. If not installed, they can install it and payment mode will be discussed and agreed on.

Notes:

- You, as the lessor, have the right to track and inspect your care anytime you wish

- You have the authority to call off the contract anytime you want.

Modes of payment

- M-pesa payment

- Bank account deposit and

- Cheque collection from Kaka Logistics Enterprises office.

How to contact Kaka Logistics Enterprises

Call them on +254721716765 or email them via info@kakalogisticsenterprises.co.ke

ARS Kenya

ARS Kenya is an established leasing and rental company in Nairobi. They offer long-term leasing services and rentals for premium clients. Clients which include NGOs, embassies, and multinationals.

Brand leasing cars/offerings

- Full sized 4WDs,

- SUVs and

- double-cab trucks from Toyota

Benefits

- Regularly scheduled maintenance and servicing.

- Oil changes, tire rotation, tune-ups, etc.

- Cash and high turnover

How to contact ARS Kenya

If you wish to contact ARS Kenya via email, write them mail via sales@ars-kenya.com.

To contact them through telephone call +254-733-927437 or +254-722-203062 to speak further with them.

Myhire

Myhire seamlessly connects renters to car owners through a mobile app. They create exposure, trusted marketplace and accessibility for both renters and car owners. You can earn more money by leasing out your car. People hire your car and you get 75% of the earnings the app generated. Payment is done 30hrs after the client check-in using the app.

Their focus is on making an integrated digital platform by equipping car rental operators with the best innovations for a better rental experience.

Procedures:

- Registration: here you download the app. Then you sign in and list your car, put your location and the price. Specify your own ground rules and state when your car is available.

- Delivering your car: you deliver your own car and collect it when the client is back. Also help the client check-in using the app, give them the keys and check out the client later. You can help them also by suggesting borrowing airtime incase an emergency arises.

- Payment: you are paid 30hrs the client checked-in and you are paid 75% of the money paid by the client.

Requirements:

- Present vehicle for inspection.

- Agree to the binding partners in terms and conditions.

- Have a registered comprehensive PSV Insurance

- The car presented should be less than nine (9) years

- 160,000 kilometres car

- Value of the car should not be less than Ksh. 700,000 payment and booking of installation of MyHire-GET

- Up to date and good safety standard history

- 7 consecutive days’ rental period

- Four (4) passenger’s seat with 4 wheels.

Vismart

You can lease your vehicle with Vismart at a very good rate up to ksh.180,000 monthly with your car lease. Vismart leases cars on a long-term basis from individuals who own personal cars.

As an individual in Kenya, you can lease your vehicles to this platform for a period of up to one year. You will make an extra income that will enable you to purchase more cars.

Their firm commitment in car leasing in Kenya has always been to create a friendship with those they lease cars from. It has been from offering long-term car lease in Kenya at amazing rates to attracting more customers.

Requirements:

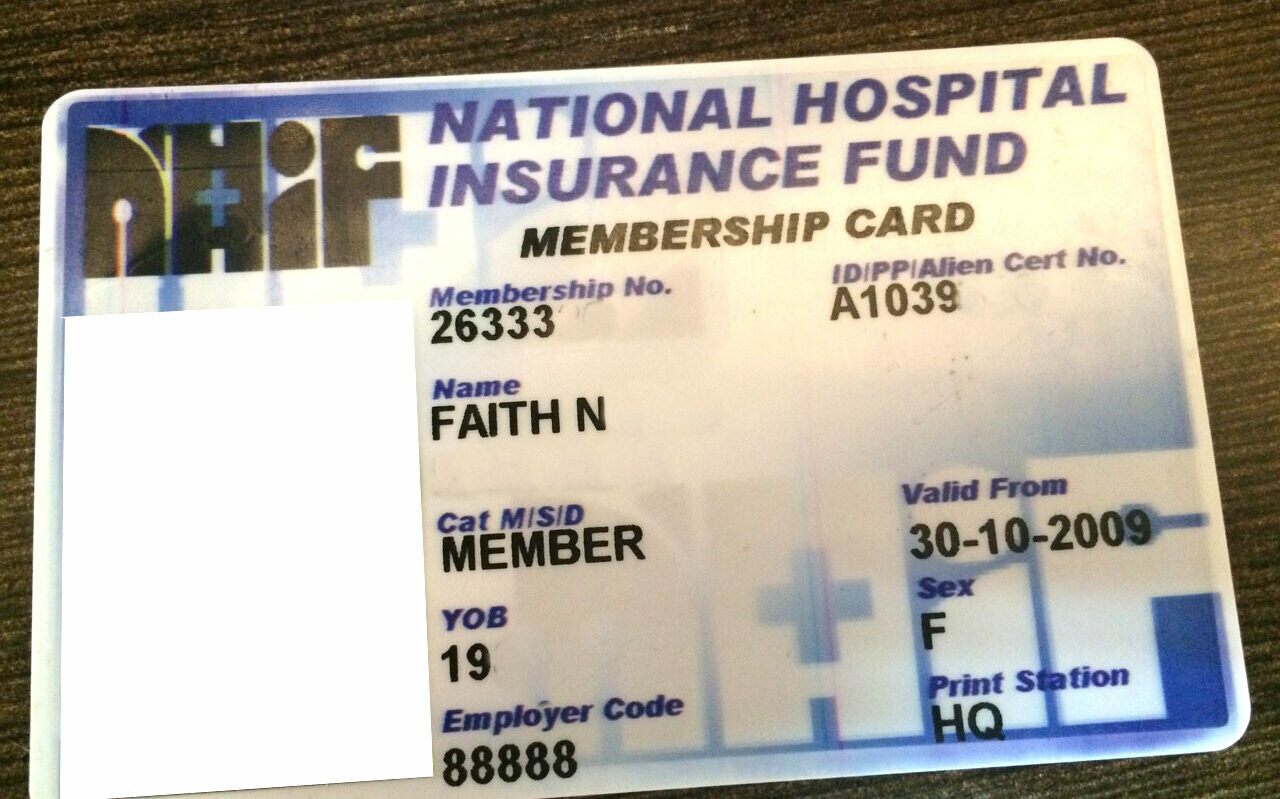

- Lessor (Car owner) will be asked to render the GPS tracker login

- Provide a copy of your log book

- Present your national identification card.

However, If you as the lessor have not installed the GPS tracker yet, you shall install it and provide the credentials to lessee

Insurance policy

While the lessee still has the car, you as the lessor shall comply with all the insurance requirements and policy expiration date.

Payments

You receive your payment on the 5th of every month. When delays occur, know that some clients have delayed payment. Once they pay up, you get your money without delay. However, know that upfront payments are not until the month elapses.

Compliance

Note that your vehicle must comply with all traffic requirements (Traffic act 2010). The traffic acts of Kenya require all rental cars to have PSV (self drive) insurance.

Conclusion

Car leasing is a legitimate way to make money in Kenya. You lease your car to car leasing companies and they pay you monthly. Leasing your car does not mean transferring ownership with them. At the end of the contract, you still take ownership of the vehicle.

You can try out these companies listed in this article for your car leasing and enjoy the benefits that come with it.