Running out of data when you need it the most can be really frustrating, especially when you don’t have airtime to quickly purchase one, or have quick cash to top up. Whether for work reasons, connecting with family or friends, or even streaming that live football match, running out of data has just one feeling- annoyance.

But here’s the good news,

If you are a Vodafone user you can quickly borrow airtime or data with just a few clicks on your phone.

In this guide, we’ll walk you through the steps on how to borrow data on Vodafone so you can stay connected whenever you need it.

How to Borrow Airtime or Data on Vodafone

To qualify for borrowing credit or data, Vodafone Ghana customers must have been active on their SIM cards for at least 15 days and maintain a loyal usage history. Your airtime balance needs to be GH¢1 or less for you to request credit. It’s important to note that a 10% interest charge will be charged upon repayment.

To borrow airtime on Vodafone, use the following steps;

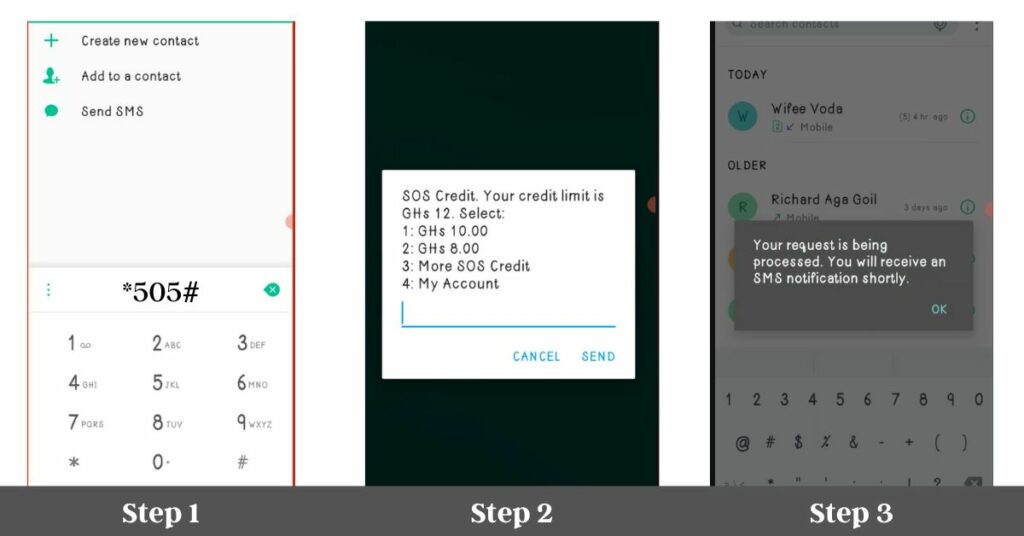

- Dial *505#

- Click on ‘Borrow Data’

- Select your preferred loan amount

- Confirm transaction

How to Transfer Data from Vodafone

You might want to transfer airtime to your family or friends. With Vodafone, you can do that easily using USSD. So, depending on which option you select, the procedures for transferring your Vodafone bundle are

How to transfer data on Vodafone using USSD code:

To share your Vodafone internet bundle:

- *Dial 700# and follow the on-screen prompts.

- Choose the data bundle you want to share or purchase a new one if needed.

- Enter the recipient’s mobile number when prompted.

- Select the amount of data you want to transfer.

- Confirm the transfer.

That’s it! You’ve successfully shared your data.

Note: You can only share data with other Vodafone users

How to Check Your Vodafone Data Balance

To check your remaining data balance:

- Dial *126# from your Vodafone number.

- You’ll receive an SMS with your data balance details.

How do I convert airtime into data Vodacom?

When your data runs out, the quickest solution is to convert your airtime to data (if you have airtime available). Here’s how to do it:

- *Dial 135# from your Vodacom number.

- Follow the on-screen prompts to select the data bundle you prefer.

- Choose to pay with airtime.

Frequently Asked Questions

1. Can you send someone credit from Vodafone?

Yes, you can send someone credit from Vodafone. However, you can only send airtime to other Vodafone customers

2. What is the code to borrow data on Vodafone Ghana

*505# is the shortcode for borrowing data on Vodafone in Ghana. By dialing *505# you can access extra airtime(credit) and data with a small fee that will be deducted upon the next recharge.

Conclusion

Running out of data or airtime is never convenient, but Vodafone has you covered with its borrowing options. By following the simple steps outlined in this guide, you can easily access additional data or airtime when needed.

Remember to use these services responsibly and adhere to the terms and conditions set by Vodafone.

Check out other related articles:

How to borrow credit on Vodafone in Ghana

Vodafone Cash Loan in Ghana – How to apply and what you should know