Traditionally, securing a loan from a bank meant putting up collateral—essentially, a guarantee that if you couldn’t repay, the bank could seize your assets.

While this offers banks a sense of security, it often results in a long and cumbersome application process for borrowers.

In recent years, technology has introduced innovative products and services, including digital banks that offer collateral-free loans with just a few taps on your phone. This advancement has made obtaining loans for Ghanaians much easier and more seamless.

In this blog post, we will introduce you to our best loan apps in Ghana that offer online loans without collateral. We will cover their interest rates, requirements, and the application process.

1. MTN Qwikloan

MTN Qwikloan is a convenient mobile app service in Ghana that offers instant loans through your MTN Mobile Money account. It’s designed as a fast and reliable solution for those in urgent need of financial assistance.

The service was birthed by the partnership between MTN and AFB Ghana, providing customers with access to cash loans via the MTN Qwikloan service. To be eligible, users must have actively used their MTN Mobile Money wallet for more than 90 days. With Qwikloan, you can borrow up to 1,000 Ghana Cedis with an interest rate of 6.9%. The primary requirements are regular use of MTN Mobile Money and a commitment to repay any previous loans.

To access a loan, follow these simple steps:

- Dial *170# on your MTN mobile number.

- Select option 5 – Financial Services.

- Select option 3 – Loans.

- Choose option 1 to register for free or option 2 to view the terms and conditions.

Alternatively, you can download the MTN MoMo app on the App Store or Google Play and navigate to the loan section for quick access.

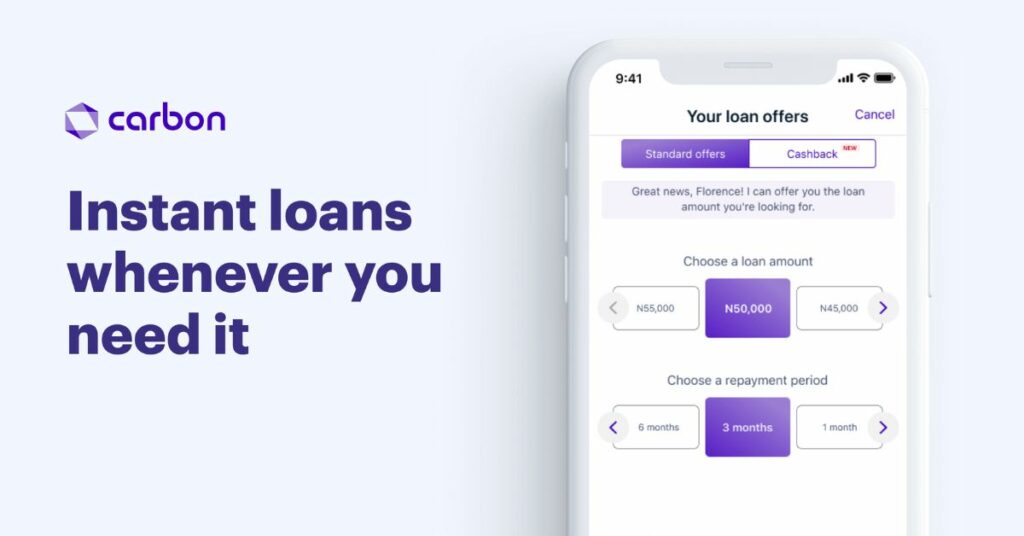

2. Carbon (Formerly Known as Pay later)

Carbon, initially launched as Paylater, stands out as one of the best instant loan apps in Ghana, thanks to its comprehensive approach to financial services.

Beyond offering quick loans, Carbon provides a wide range of financial solutions, from meeting urgent cash needs to settling regular utility bills. This multifaceted functionality allows Ghanaians to consolidate several financial activities within a single platform, offering unmatched convenience.

To apply for a loan, users simply need to create an account on the app and fill out the application with basic information. Once approved, funds are disbursed within five minutes.

Loan Details

- Loan Amount: GHS 100 to GHS 5000

- Interest Rate: 4.5% to 30% monthly

- Repayment Period: 1 to 12 months

Additional Features

Carbon Zero: Shop on a loan and pay with 0% interest, making it an even more attractive option for managing finances.

3. Fido Loan

Fido Loans are provided by Fido Micro Credit (FIDO), a financial institution based in Accra. As a private money lender, Fido offers loans through their Fido Loan app to anyone with a valid ID and a mobile money account, with no need for collateral or guarantors.

Loan Features

- Initial Credit Limit: First-time customers can secure a credit limit of up to GHS 280. By consistently making timely payments and strengthening your financial profile with Fido, you can improve your credit score and access up to GHS 4000 from your personal credit line.

- Flexible Repayment Options: Fido offers installment plans of up to 6 months. This means you can repay your loan in small, equal amounts over 3 or 6 months, instead of repaying the entire amount after the usual one-month period.

- Interest Rates: Interest rates start at 14% for 30 days for new customers and can go as low as 8% for 30 days for returning customers.

Zidisha Loan

Zidisha is an online microlending community that directly connects lenders and entrepreneurs without intermediaries. To qualify for Zidisha loans, you need the Zidisha app, a valid ID, and a good reputation based on recommendations from friends and family.

How It Works

- Loan Applications: Entrepreneurs post their loan applications on the Zidisha app, detailing the amount needed and the reason for the loan.

- Funding: Individuals on the app can choose to fund part or all of the requested loan amount.

Loan Details

- Loan Amounts: Loans can range from as little as $1 to the full amount requested by the entrepreneur.

- Interest Rates: There is no interest rate when borrowing from Zidisha.

- Fees: There is a service fee of 5% of the loan amount and a one-time membership fee of 40 Ghana Cedis.

SikaPurse

SikaPurse is a loan app in Ghana that offers quick, collateral-free loans. With SikaPurse, you can access loans ranging from GH₵ 2,000 to GH₵ 5,000, with flexible repayment periods ranging from 90 to 365 days.

If you apply for a loan of GH₵ 5,000 with a 90-day repayment period and an annual interest rate of 10%, your total repayment amount will be GH₵ 5,123.

Eligibility Criteria

To qualify for a SikaPurse loan, you must:

- Be a Ghanaian citizen

- Be between 22 and 55 years old

- Have a valid means of identification

Important Considerations Before Using Loan Apps

Loan apps offer a fast and convenient way to access cash, but it’s crucial to be aware of everything in between before proceeding. Here are some key points to consider:

- Borrowing Responsibly: Loan apps are a tool, and like any tool, they should be used responsibly. Only borrow what you absolutely need and can realistically repay within the loan term. Don’t use loan apps to cover unnecessary expenses or gamble with your finances.

- Interest Rates and Fees: Be aware of the interest rates and any associated fees charged by the loan app. These can vary significantly between apps, and the Annual Percentage Rate (APR) can be much higher than traditional loans. Avoid apps with hidden charges or unclear fee structures.

- Repayment Terms and Penalties: Understand the repayment schedule and any penalties for late payments. Missing payments can quickly increase your loan amount and lead to a debt spiral. Make sure you can comfortably afford the monthly repayments before borrowing.

- Download from Official Stores: Always download loan apps from official app stores like Google Play Store or Apple App Store. This helps ensure some level of security and reduces the risk of being scammed.

Conclusion

Loan apps can be a lifesaver when you need quick access to cash for emergencies. The convenience and speed of the application process, coupled with the lack of collateral requirements, make them an attractive option for many Ghanaians. However, responsible borrowing is key. Remember to prioritize affordability, compare loan options, interest rates, and fees, and only borrow what you can realistically repay on time.