Supreme Finance, a notable financial institution in the lending industry, offers a variety of financial products designed to meet your unique borrowing needs. If you’re considering a loan from Supreme Finance, this comprehensive guide will walk you through everything you need to know.

What Does Supreme Finance Do?

Supreme Finance is a reputable financial institution that provides a range of lending services to individuals and businesses. It is a licensed and registered lending institution, ensuring a secure and trustworthy borrowing experience. Their commitment to compliance and transparency sets them apart in an industry where trust is paramount.

How to Apply for Supreme Finance Loans

Getting started with Supreme Finance loans is a straightforward process. They offer a user-friendly application process to facilitate your borrowing needs. To apply for a Supreme Finance loan, you can follow these steps:

- Visit the Supreme Finance website or contact their nearest branch.

- Fill out the loan application form, providing all required documents.

- Await loan approval, which typically takes a few business days.

- Once approved, you’ll receive the loan agreement and disbursement details.

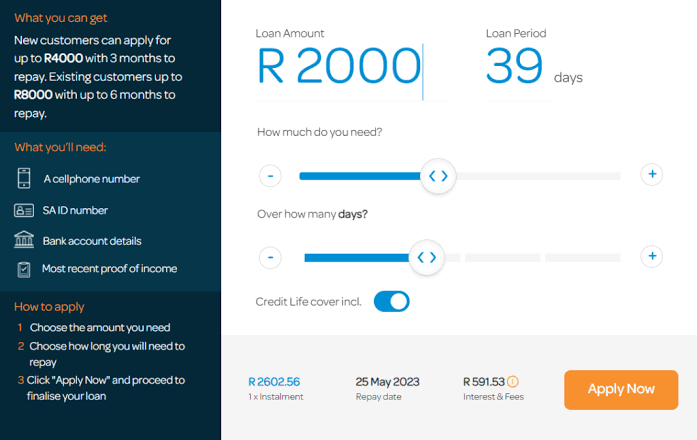

Supreme Finance Loan Requirements

Before applying for a Supreme Finance loan, be sure to meet the following requirements:

- A valid identification document (e.g., driver’s license or passport)

- Proof of income or employment

- Bank account details for loan disbursement

- Social Security number (if applicable)

- Evidence of residence, such as utility bills or rental agreements.

How Long Does It Take to Approve Supreme Finance Loans?

Supreme Finance understands the importance of timely loan approvals. The typical approval time can range from a few hours to a few business days, depending on the type and amount of the loan, as well as the completeness of your application.

Does Supreme Finance Do Credit Checks?

Yes, Supreme Finance conducts credit checks as a standard part of their loan approval process. A good credit score can positively impact your eligibility and interest rates, but those with less-than-perfect credit are still encouraged to apply.

What Is the Interest Rate for Supreme Finance Loans?

Interest rates for Supreme Finance loans may vary depending on the type of loan, your credit score, and the current market conditions. However, they are known for competitive rates (which could be sometimes as low as 3%) that are often lower than what you’d find with many traditional banks

How to Repay Supreme Finance Loans

Repaying your Supreme Finance loan is a hassle-free process. Here’s a simple guide:

- Set up a direct debit from your bank account for automatic payments.

- Ensure your account has sufficient funds to cover the monthly repayment.

- Make manual payments through the Supreme Finance website or at their branch.

Pros and Cons of Taking Supreme Finance Loans

Obtaining loans from financial institutions typically comes with pros and cons. The pros and cons of obtaining a loan from Supreme Finance loans include:

Pros:

- Competitive interest rates

- Fast and efficient loan approval

- Varied loan options to suit different needs

- Clear and transparent lending terms

- Excellent customer service.

Cons:

- Credit checks may affect eligibility for some borrowers.

Contact Details of Supreme Finance

For inquiries, you can reach out to Supreme Finance via the following contact information:

- Website: https://supremefinance.co.za/

- Phone: 086 055 5440

- Email: info@supremefinance.co.za.

Conclusion

Supreme Finance loans offer a reliable solution for individuals and businesses seeking financial assistance. With their commitment to responsible lending, competitive rates, and efficient loan approval process, Supreme Finance is a financial institution you may want to explore for your borrowing needs.