For the average investor, trading on the stock market can be confusing. The same goes for most South Africans. For some, investing in the stock market is risky, but for others, it is the best way to build wealth quickly. Easyequities In South Africa is an investment platform in South Africa that facilitates trades about tax-free savings investments and equity investments as well as ETFs and other investments.

With investments starting at R0.01, it is the cheapest investment platform in South Africa. A variety of factors determine the minimum investment amount, however, each trade has its own minimum investment amount, which may push the required minimum investment amount above R0.01.

About Easy Easyequities In South Africa

Easy Equities is part of the JSE-listed Purple Group Limited and is headquartered in Braamfontein, Johannesburg. As an effort to create an investment platform that is affordable and easy to use for all South Africans, the company was founded in 2014.

Easy Equities operates legally in South Africa and has a trading license number 22588 from the Financial Sector Conduct Authority (FSCA). First World Trader (Pty) Ltd is registered with the Financial Services Compensation Authority, which allows EasyEquities to trade as a financial service provider.

What Is Easy Equities?

Easy Equities is a South African investment platform that allows its users to invest fractionally in bonds and shares. The stock market allows you to invest as little as R5 with various local and international markets. It aims to improve the financial situation of many South Africans.

The emergence of the internet and technological advancements have changed South African stock market investments. Purchasing fractional shares allows you to enjoy the economic benefits of owning whole shares without sacrificing your earnings. Investing in fractional shares gives you fractional rights as you purchase more shares until you possess the total number of shares.

After you complete the fraction, the platform delivers the whole claim to you. Therefore, every Rand you invest counts, and you eventually have a chance to own full shares on the South African stock market.

How Easyequities In South Africa Work

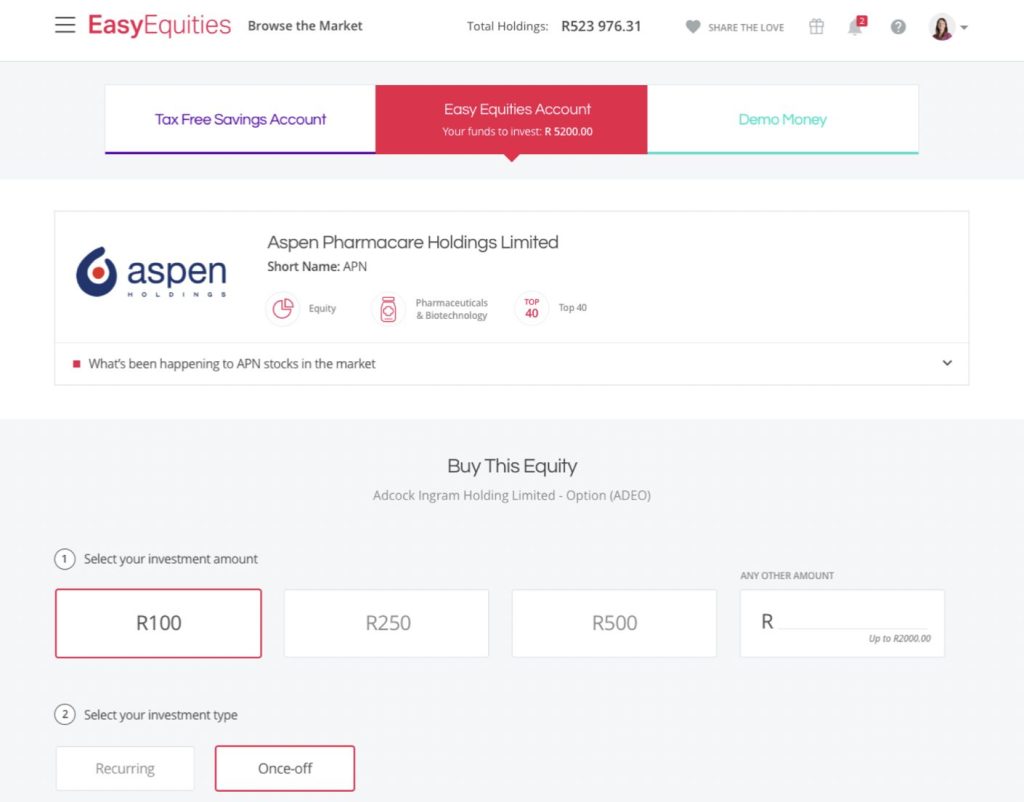

Easy Equity is a straightforward platform with a user-friendly website that is friendly to both new and old users. The registration process is simple, and you only need to go to Easy Equities’ website, register with them, and then log in once your account has been approved. Registration is free, and there is no monthly fee for the account.

As a thank you for registering, you’ll receive an award of R 100 000 deposited in a ZAR account and $1000 deposited in a USD account for demo use. Afterward, you can locate familiar brands that you would like to invest in. You can also invest in Easy Equities demo with ETFs and bundles of selected shares. The demo is designed to familiarize you with how easy it is to invest in stock markets listed on the EasyEquities platform.

As soon as you understand how it works, you can start using real money to purchase. To begin, complete your profile and register for a live account. Easy equities offers three different accounts: ZAR, USD, and ZAR tax-free savings. If you activate your account, you can choose between a ZAR account or a USD account.

One of the best features of Easy Equities is that it has a ZAR tax free savings account, which is ideal for South Africans with low income. The platform automatically activates this account when you register on the platform. This tax-free investment method allows you to invest in baskets, ETFs, and bundles without being taxed on capital gains, interest, or dividends.

Easy Equities Account Setup

Setting up an account with Easy Equities is easy.

- To register, click here.

- First, you will create an account with your basic details.

- As soon as you activate your account, you must verify your identity and location. This is the only part of the easy equity application process that requires paperwork.

- Attach a copy of your ID and any utility bill or bank statement that shows your address.

- Upload your ID copy and any utility bill or bank statement that has your address.

- As soon as your account has been verified, you can deposit money by direct deposit, EFT, or credit card.

How to Use the ZAR Tax-Free Savings Account (TFSA)

The South African National Treasury allows you to invest in ETFs, Bundles and Baskets using yourTFSA for a lifetime investment limit of R500 000. It involves a simple process in which you first fund your TFSA account with your accessible equity account number.

Having deposited, you can now browse for investments on the platform’s website. Select from the list of ETFs or Baskets and Bundles. Click on the “BUY” icon and enter the amount that you wish to invest!

How to Move TFSA From Current Provider to Easy Equities

Are you aware that you can transfer your TFSA from one provider to an Easy Equities account? That is one of the benefits of Easy Equities. However, before you start the process, you need to understand the two types of TFSA accounts available in the South African market. Each type affects the transfer process differently. There are two types of TFSA accounts:

1. Investment TFSAs

Using this account, you can invest cash or funds in assets that include shares, bonds, and exchange-traded however, it is the easiest TFSA to transfer because of its liquidity.ed funds.

2. Bank TFSAs

Your funds are held in accounts that earn interest while being held in cash form. The account does not include the purchase of Exchange-Traded Funds (ETFs). However, it is the easiest transferable TFSA because of its liquidity state.

Transfer Process

The TFSA transfer process is easy, and all you have to do is:

The first step is to create an Easy Equities account, then fill out section A, which contains investor information. You can also use this form to transfer your TFSA funds. To do so, just enter your TFSA account number into the box on the form. In case you have a bank account, TFSA transfers your funds in Rands, and if you have an investment TFSA, you can transfer units, shares, or cash.

If you want to transfer a partial amount or the entire amount, you can do so. Enter your EasyEquities User ID in the transfer to a part section of the form application. Once the transfer has been completed, be sure to notify your former broker and Easy Equities by emailing the application form to both.

It can take TFSA 2-4 weeks to complete a transfer from one broker to Easy Equities. It is important to note that TFSA accounts have a contribution limit, and the two parties will need this time to take care of all the details of the transfer of investments or money. Also, note that transfers do not take place at the end of the tax year because they can cause problems because of your annual and lifetime contribution limits.

Is EasyEquities safe and legit

It is certainly legal in this sense to invest with EasyEquities. In addition, there are other factors you may consider when viewing EasyEquities’ safety, such as EasyEquities’s listing on any exchange, providing two-step logins, disclosing transparently its financial results, etc.

Can you make money on Easyequities In South Africa

Practicing makes perfect, so you receive a demo account of R100,000 and a demo account of $10,000. Check out the brands you know and love on the Invest Now page. There are also baskets, bundles, and ETFs that let you buy a lot of preselected shares all at once.

Does EasyEquities have a stop loss

If you wish to sell at R10 before you put your stop loss at R00, you can now do so. When the Selling AT (BID) price of this share reaches R10, you will receive the dividend. 00 (or lower), the system will automatically sell your share, effectively stopping any further losses.

Advantages of Easyequities In South Africa

Some of the advantages of EasyEquities include:

1. Low Invests Cost

Easy equities allow you to invest as little as R5. Registration is free on the platform as well. Consequently, you can invest in stocks and ETFs using your Tax-Free Savings Account (TFSA). You are not limited to the number of shares you can purchase per month with this account.

2. Mobile-enabled

Using your smartphone, you can download the EasyEquities app or visit their website. As a result of the collaboration, Easy Equities and Telkom now allow you to transfer money using your WhatsApp or online payment wallets when purchasing shares.

3. Easy Sign Up

Easy equities accounts are easy to open. You need only provide brief information, such as your name, address, and ID number. Once your details get verified, the agent opens an account for you to deposit money and buy shares.

Other advantages include

- Easy equities offer all its customers quality customer care services with personalized services

- The agent allows you to deposit money into the EasyEquities account using your credit card, Eft, and direct deposit.

- The platform has a beautiful, easily navigable, and intuitive user experience. Easy Equities made it to help you invest in stock markets you love.

- The platform’s website boasts of search functions that easily find what you are searching for.

- It allows you to transfer your funds from a different broker in a simple process. The platform accepts full or part transfers.

Disadvantages of Easyequities In South Africa

Despite its pros, EasyEquities also has its cons. They include:

1. Lacks Live Chat and Phone Access

It is not possible to contact Easy Equities customer service agents via live chat on the website. They also have an unresponsive phone number that is rarely answered.

2. Limit to Stock Analysis

On their website, users can only access stock analyses and essential chatting tools. Additionally, it has integrated TFSAs as well as stocks and ETFs into the site. Bank TFSAs are limited, which may lead investors to believe that they are not available.

3. Fractional Shares

Fractional shares purchased on the platform do not entitle you to vote on the stock market. Only when you purchase whole shares do you gain rights, and only then does the agent transfer your ownership of the shares.

Other advantages include

- The platform is only available in English, which is a disadvantage for South Africans who do not understand English.

- The platform provides a one-step login only, which is risky. It should at least include a two-step authentication for more security.

See: Top 10 assets South African are currently investing in 2023.

Final Thoughts

The EasyEquities platform makes it easy for new investors to access the stock market. While other platforms require large capital to open an account, Easy Equities allows South Africans to invest for as low as R10 – no other platform offers this feature.