Unexpected issues which do not have emergency savings cover could derail your carefully laid spending plans. If you aren’t able to cater for the expense, you will have to resort to loans. Loans come with an interest rate and an agreed repayment date. There are many apps that can loan you money in Kenya.

Let us take a closer look at these apps and help you stretch your funds farther.

5 Apps that Loan You Money

Millions of Kenyans live on loans and may need an option when their cash flow is tight. These apps help you solve your short-term liquidity issues. To be able to have money options, let us discuss 5 apps that loan you money. They are:

KCB M-Pesa app that can loan you money

This loan app has built a name in Kenya. It offers quick loans and gives a minimum of Ksh 500 and a maximum of Ksh 1,000,000 to its customers. KCB M-Pesa was born from the partnership between M-Pesa and Kenya commercial bank. However, for one to qualify, you need to be an active Safaricom M-Pesa customer for at least 6 months.

Features of KCB M-Pesa App

- KCB M-Pesa has more than 1million downloads on play store.

- It has 36,182 reviews on play store

- 4.2 /5 ratings on Google play store

- Has 9.1MB Memory capacity

- The application is easy to operate

- A well-designed view clearly spelling out all functions of its products

- Has a unique and catchy colour

Tala loans

Tala loan was the first mobile application launched as Mkopo Rahisi, but currently known as Tala. It is a trusted loan app that has gained trust over the years. Customers get a minimum of Ksh 500 and a maximum of Ksh 50,000 with an interest rate of 15%. In addition, to be qualified, the Tala app needs you to have a smartphone with a good M-Pesa history.

Features of Tala loan app

- Quick communication to the server for easy operation and dispense of funds

- Ability to secure data and other personal information

- More than 5million downloads on Google play store

- A star rating of 4.5

- Has 405,478 review on Google play store

- Requires android version of 4.03+

- Nice colour combination that is dim and doesn’t affect the eye.

Branch loan

Branch loan is a financial institution in San Francisco with a branch office in Nairobi, Kenya. It started in 2017. Customers access loans from Ksh 1000 to an unknown maximum amount. More so, for one to qualify, you need to have a Facebook account with the same name as the one on your national ID card. You also need to be a registered M-Pesa user. Interest rates vary and depend on the amount and repayment duration.

Features of branch loan app

- Branch loan app has 321,038 reviews on Google play store

- The app is easy to operate and navigate through

- Has more than 10million downloads on play store

- 4.3 star ratings, which is good.

- An intuitive design for improved borrowing experience

- Showcases loan offer available to its customers

- Amazing view and different repayment options you can choose from.

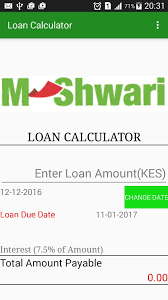

Mshwari loans

Mshwari started in 2014 and offers its leading services through M-Pesa , in partnership with Commercial Bank of Africa (CBA). Customers can apply for loans of Ksh 100 to an unknown highest limit. It has a repayment duration of one month with an interest rate of 7.5%. Conclusively, Mshwari requires you become a Safaricom subscriber and have a registered M-Pesa line to qualify.

Features of Mshwari loan app

- Easy to use and navigate through.

- Fast in loading

- Reads phone data and keeps all data or information collected safe.

- Displays available loan limit

Saida app that can loan loan you money

To qualify for Saida loan, customers need an active M-Pesa/Airtel money account. Once you install the app on your phone and you apply for a loan, the app reads and tracks all your call activities. They also track all your transactions to know if you can pay back the loan.

Features of Saida app

- 3.6 star ratings and 10,184 reviews on play store

- 500k downloads on Google play store

- 5.9MB memory capacity

- Easy to use and loan applications don’t take too long to get to the server.

- Offer other products, which are also easy to access.

Conclusion

Apps that loan you money in Kenya are a league of their own. They have proven to be a lifesaver to citizens of Kenya. It allows them to cover urgent expenses. What is greater about some of these apps that loan your money is that you do not have to worry about too much interest rate. Some fees are waived off and duration extended. Hope you found the content interesting?