An important barrier to the growth of businesses and companies in Kenya is finance, especially for SMEs that contribute to the large share of the economy. Working capital is also the key to the success of every business. There are several instruments you can deploy to finance business and, thus, the likes of trade credit.

Trade credit is an essential tool for financing business growth. To get this trade credit, you need a properly prepared financial plan and an established relationship with the supplier.

When you are first starting a business, however, suppliers won’t be disposed to sell to you on credit. While this is a fairly normal tradition, you can still negotiate with the supplier. Depending on the terms, trade credit is favourable to buyers because it is a credit given to you by a supplier who allows you to buy now and pay later.

What is a Trade Credit?

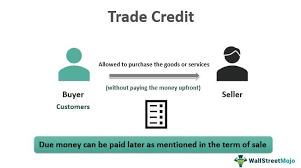

Trade credit is a business arrangement where a buyer accesses products from the supplier without immediate payment. The buyer pays on a scheduled agreed date. Usually, businesses that deal on trade credit have limits of up to 30 days to 90 days to pay up.

They record trade transactions through an invoice and have a 0% financing. Goods are exchanged between two parties, called the buyer/customer and the supplier/seller.

The customer then supplies to the consumers and pays up later. This process of exchange of goods and extension of payment is called trade credit.

Understanding Trade Credit

Trade credit is offered to a buyer by a supplier in which they make payment on a later agreed date. The platform is a significant advantage for the buyer. In most cases, buyers negotiate a longer trade credit repayment date, which provides even more advantage.

Suppliers have criteria for qualifying for trade credit, which includes the capacity to pay back and an established mutual relationship between both parties.

Number of days for the credit is determined by the supplier or the company offering the credit. Then is agreed upon by the two entities. Trade credit is a good way to finance short-term growth and maintain a consistent supply of product when you lack finance.

Relatively, trade credit requires no interest and also encourages sales. Sellers often see it as a disadvantage to them, but they fill the gap by offering a discount. They offer a certain discount amount for buyers to pay up early.

How does trade credit work?

Trade credit is an advantage to business to business, which helps a party get, manufacture and sell goods before ever having to pay for it. The platform allows companies to receive a revenue channel that can cover costs of goods sold. To go further, different ways that trade credit works are:

- The supplier/seller sets and defines the trade credit terms and repayment date.

- Suppliers and buyers agree on that date before they seal a contract.

- The deal often includes some type of penalty for late repayment and a bonus for early payment. All these terms depend on the supplier.

- Sellers usually send an invoice along with the orders made by the buyer, letting the buyer know how he owes.

- These processes are properly recorded and appear on the balance sheet for future references.

Trade Credit in the Real World

Trade credit mostly helps businesses to find avenues to maintain trade flows and growth. New firms that do not possess an established flow of income yet can get a trade credit, but it all depends on the suppliers.

Some can get it through a mutual relationship with the supplier. Once the buyer is sure of selling off the products immediately to the consumer and paying off the credit, he goes for trade credit.

The rise of trade credit as an alternative means of payment has brought growth to some businesses. They have also found that trade credit has financed an approximate 20% of all investments and businesses in Kenya.

To sum it up, trade credit in the actual world of Kenya is doing great and putting smiles on every business that encounters it.

How can I get trade credit?

If you are looking towards opening a trade credit, approach your supplier first. A supplier you currently work with and have developed trust with. You can also start with the vendor equally.

Advantages

An agreement on trade credit has a lot of advantages for both the buyer and the supplier. The advantages are:

- Easy to arrange and operate

- Proves and increases supplier’s reputation

- Gears towards business growth

- It is a tool used by most business, for supplies of goods or services

- Enjoyment of discounts and bulk buying

- No payment upfront

- The buyer enjoys a competitive edge and adapts to market demand.

- A yielding and potentially low-cost form of working capital finance.

- An easy and straight source of short-term finance.

- Trade credit reduces the huge capital requirements of businesses

- Helps companies and suppliers focus on core activities, which is manufacturing and immediate sales.

- It serves as a strategy for winning new customers, increasing sales

and keeping customer loyalty

Disadvantages

Access to robust trade credit can seem a lifeline for a cash-strapped business. Also note that if the root of your business means you are likely to not pay back, think again about relying on trade credit. The disadvantages are:

- Hard to get for startups and businesses without evidence of cash flow

- Penalties and interest await the buyers when they cannot make payments.

- Legal action can occur parenting the supplier to sue the buyer.

- The buyer can get a negative impact on credit rating

- If the buyer meets up with the bargain, he can lose the supplier

- Cash flow issues. Late repayment and default can lead to a serious cash flow for the supplier.

- Problem of prolonged customer assessment

- Presents a serious challenge of bad debt to the supplier.

Example

A retailer that sells solar panels and inverters under which the distributor agrees to provide him with panels and inverters under agreement of “Net 80”. The supplier offers the retailer a 10% discount on payment within 50days and a 20% discount on payment within 30days. Meaning that the retailer has 80days to pay up the invoice in full. When so many consumers request the panels and inverters, the retailer may pay up in full or part within 30days and enjoy a 20% discount on the panels and inverter. However, if sales are bad, the supplier can pay up within 50days and enjoy a 10% discount.

The supplier of the panels can also do the same thing. Receiving trade discounts from the manufacturing company that produces inverter components. They may agree to a term and the supplier gets them on credit,if sales are good, the supplier pays up early and enjoys the discount.

Why Companies Offer Trade Credit?

Trade credit is a common way to finance small businesses to generate income to circulate in the economy. The reasons companies offer trade credit are:

- It is an alternative to other expensive loan applications. Sellers also use it to boost buyers.

- Trade credit is a sale tool and strategy

- It serves as a signal from companies to businesses showing that they offer high-quality products.

- A means to sell off a product by the companies who are in a competitive and tight market.

Where can I find companies that offer trade credit?

Much of the businesses in Kenya run on trade credit. But many companies or suppliers might not offer trade credit to new businesses. While it’s easier to get the supplier’s credit, it is also easier to become one if you are into product manufacturing.

Fortunately, many companies in Kenya offer trade credit terms to businesses. You see these companies by:

- Locating different manufacturers in Kenya.

- Locating a Vendor

- Visiting a previous seller.

How is trade credit different from bank credit?

Banks and financial institutions offer cash through loans, credit cards, etc. But a supplier offers a Trade credit to a business with specified terms where the buyer pays later. Trade discount involves selling off products while bank credit involves lending loans.

What is the formula for the cost of trade credit?

Trade credit is represented by three numbers, viz:

- The first indicates a discount percentage

- The second shows discount period while

- The last portrays the final due date.

Features

The features of trade credit are the different things that make up the trade credit. It also includes how, where, and what trade credit is. The features are:

- It operates on an informal legal instrument or debt acknowledgement.

- An arrangement between the buyer and the supplier/company

- It follows purely an internal arrangement system

- It is basically a spontaneous source of financing for businesses.

Trade Credit Instruments

They offer most credit on open accounts or mere written agreement. But as time went on, because of failure to keep to a binding agreement, they deployed different instruments. The different instruments used are:

- Invoice: this is an instrument generated by the supplier and sent along with the goods. The buyer therefore signs as an evidence of receiving the goods

- Account books: the supplier and the buyer have different accounting books they keep for record purposes. They both record series of trade credit transactions on this book

- Promissory note or IOU: the platform is used when the buyer offers a large product and when the supplier expects problems in fund collection. It is signed after delivery

- Commercial draft: commercial draft is a written document which serves an instrument to trade credit. It is written by the supplier to the buyer to pay an amount of funding on a particular date. The supplier sends the draft and the invoice to the buyer or the buyer’s bank. It depends on the supplier. When the bank receives and accepts it, they invite the buyer to sign the draft.

- Banker’s acceptance: this is also a trade credit instrument which is written by the bank when they accept to pay for a customer’s product and the customer paying them on a later date.

Conclusion

Trade credit financing is encouraged globally and in Kenya by regulators and can create so many opportunities. Opportunity for new financial technology solutions and growth. Bearing this in mind, trade credit is a means of financing businesses. As a buyer, you can enjoy trade credit to the fullest.

To the suppliers, you will need to get professional legal help to write binding terms and conditions. You also need dedicated account handlers to ensure that outstanding invoices are chased up and payment recovered. Setting clear invoice agreements and ensuring good communication can help encourage buyers to pay promptly and regularly. Check out new instruments and updates on trade credit and follow the trend.

Finally, deploy capable hands to investigate online accounts software with CRM and invoicing. These modes are ways of ensuring healthy trade credit.