WohiaSika Loan is one of the loan offers you can try out in Ghana. Also, financial institutions (both online and offline) have embraced a paperless system to reach more clients in this modern time. The Vodafone Cash Loan, Fido Loan, and MTN Qwik Loan are examples of such loans. However, in this article, we will examine the requirements, how to apply, and the interest rates of the WohiaSika Loan.

About WohiaSika Loan

In Ghana, WohiaSika is a new Fintech platform or mobile lending application. WohiaSika is an application in Ghana that can quickly provide loan services based on users’ credit value with simple steps. To acquire the loan limit from them, simply complete our online loan application. No collateral is needed.

What are the requirements for WohiaSika Loans?

In order to determine whether they are qualified for a loan from them. Therefore, applicants must first review the requirements listed below:

- You must be a Ghana Resident.

- Be between 18-60 years old.

- You must have a good credit score.

How do I apply for a Loan from WohiaSika?

Their loan application is easy to complete. You should follow the steps listed below to get a loan. Installing the WohiaSika Loan mobile app is required before the loan can be instantly deposited to your account.

- Start the WohiaSika mobile app on your smartphone.

- On the Wohiasika app, create an account.

- Click the “request for funds” button on the WohiaSika Loan mobile app.

- Fill out the loan application in the APP with the information from your personal and mobile money accounts to apply.

- After providing the necessary details, receive your money immediately.

- Get a bigger loan amount by making on-time repayments.

Wohiasika Loan Contact numbers

For more information, content or suggestions:

- Email:wohiasika@gmail.com

- Tel: + 233 20 163 3088.

- Address: No54 Fanofa Street Kokomlemle, Accra.

What is the maximum and minimum amount of WohiaSika Loans?

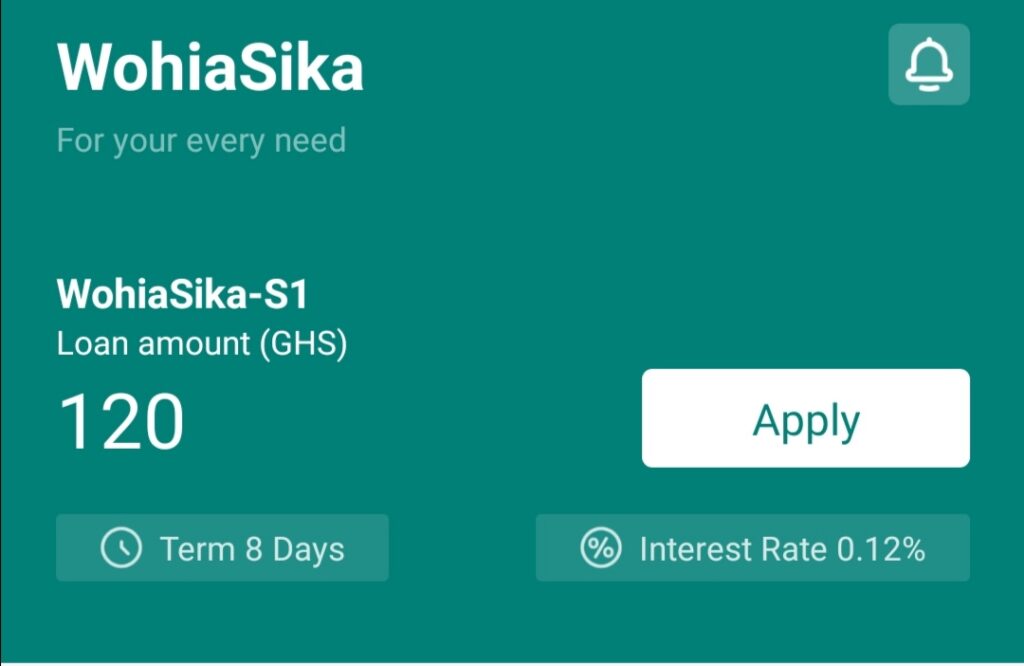

Before applying for any loan type, you should know the minimum and maximum loan amount the lender is offering. This will help you know whether such a loan will meet your financial needs. For WohiaSika Loans, you can get a minimum loan amount of GH₵100 and a maximum amount of GH₵5,000. However, on initial application by new borrowers, they are only eligible for 100–200 cedis.

WohiaSika Loans Interest Rates

The interest rate on their loan is from 10.95% to 22.31% per annum, with a service rate from 0 to 1%.

For a better understanding, the following example will show you how they calculate your interest rates on their loans:

A loan of GH₵5,000 with a duration of 100 days, will accrue an annual interest rate of 10.95%, and a 0 service rate. Therefore, the daily interest rate = 10.95 % /365 = 0.03%, the interest for 100 days = 5,000 × 10.95 % /365 × 100 = 150.

The total repayment = 5,000 + 150 = 5,150.

What is their Loan term?

Every loan comes with a loan term. Because of this, you should know the terms of the loan you are applying for. The WohiaSika Loan term is Loan 91-365 days.

What are the benefits of WohiaSika Loans?

As a borrower, there are some benefits you will gain in getting funds from them. They include:

- To get the loan limit from WohiaSika, simply complete their online loan application.

- Your private information is secure. No disclosure to third parties.

- WohiaSika does not require collateral.

- Simply completing their online loan application will provide you with the loan limit.

- No paper contracts or agreements are required; everything may be done through their smartphone app.

- If you meet all of their requirements, you can have a loan approved right away.

Conclusion

There are many online money lenders here in Ghana and WohiaSika is one of them. Of course, lack of cash flow often makes people seek financial backup from lenders as loans. However, beware of loan sharks who would offer you loans without wanting to know your capability of repaying them.

Leave a Reply

You must be logged in to post a comment.