Wonga has become a well-known name whenever short-term loans are discussed. This is due to their services catering to the diverse needs of South Africans by providing temporary financial relief and a structured repayment plan. It functions as a payday loan service for both personal and short-term loans.

Wonga originated in the UK but quickly expanded to South Africa and Poland. They offer easy access to foreign currency for individuals.

One of the most appealing aspects of their service is the online loan application and decision-making process. This provides convenient access and a quick response time.

This post will reveal how Wonga loans work, including their interest rates, requirements, application process, and other relevant information.

Keep reading to learn more…

How does Wonga loan work

Applying for a Wonga loan is a breeze. Everything is done online, ensuring a quick and convenient experience.

Here’s how it works:

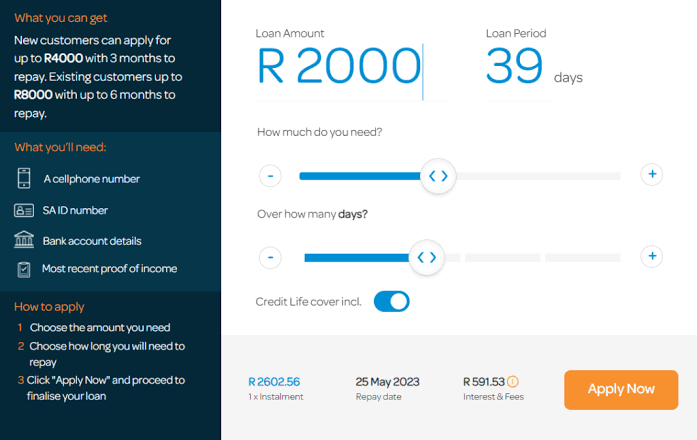

- Set Your Loan Amount and Repayment Term: On the Wonga homepage, simply adjust the sliders to choose the amount you need and the repayment period that fits your budget.

- Transparent Costs: The loan calculator will instantly display the total cost of your loan. There are no hidden fees, so you’ll know exactly what you’re getting.

- Apply with Ease: If you’re happy with the terms, click “Apply” to begin the application. You’ll be prompted to enter some personal details and banking information for a super-fast credit check.

You should get a response almost instantly, and if the loan is approved, they send the loan to your bank account.

In order to process a successful loan, Wonga will require you to provide proof of income. This is where you submit your proof of income (payslips or bank statements with your personal details)

Wonga loan paramaters

- Interest rate for new customers: 5%

- Interest rate for existing customers: 3% -5%

- Loan limit for new customers: R4000 for up to 3 months

- Loan limit for existing customers: R8000 for up to 6 months

Requirements for a Wonga loan

Here’s a list of requirements you need to apply for a Wonga loan;

- Identity proof that you are a South African

- A payslip that includes data on your last and present wage in the previous 30 days;

- You need to create an account on the Wonga website and log in;

- Bank account details;

- You should also be at least 18 years old.

Can you get a Wonga loan with bad credit

With a low credit score, you may have limited options, but that does not mean you cannot qualify. We will only approve your loan request if we believe you will be able to pay back your debt. Taking a step back and looking at your finances might be a good move if your credit score is low or if you have previously had trouble repaying your loans. There are also loans for bad credit scores available.

In most cases, if you need a payday loan and have an unsatisfactory credit history, the application process will be the same as for someone with a good credit history; however, your borrowing terms may be more restrictive. It may be necessary for you to provide more information about your ability to pay back.

You can learn more about financial literacy with the Wonga Money Academy if you’re ready to master your money. Consider reviewing your knowledge of debt, savings, budgeting, and investing, and seeing where you might be able to improve?

How much can you get with a wonga loan?

The minimum/maximum amount you obtain as a loan with wonga depends on whether you’re a new or existing customer. New Customers can get a loan for up to R4000 rand from Wonga, which should be repaid within 3 months. Existing customers can apply for a maximum of R8000, and they have 6 months to repay.

Does Wonga do long term loans

In most cases, personal loans are repaid in monthly installments over a period of up to 24 months. For new customers, Wonga’s personal loans allow you to borrow up to R4000 and repay within three months. If you are an existing customer, you can borrow R8000 and repay it within six months.

Wonga Loans: Repayment Terms

During the loan application process, all fees are clearly communicated to you. It is agreed that you will receive a loan amount, which you will repay on a specific date, usually up to 6 months for existing customers and up to 3 months for new customers

Once the payment deadline arrives, Wonga deducts the agreed-upon amount from your bank account. This happens every month until the whole amount is repaid.

Does wonga loan perform credit checks?

In contrast to other internet lenders, Wonga doesn’t require faxing documents or waiting on hold for lengthy periods of time. The application and payment process is entirely online since they have a sophisticated credit reference system.

Using their technology, they are able to assess applications in seconds and ensure that they only lend to people who are capable of repaying the loan. They simply don’t lend to anyone who isn’t.

Wonga conducts a credit check as part of the application process, so you may also see an improvement in your credit history when you repay an online cash advance from Wonga. This is because they inform their credit bureau partner about your timely repayment behavior.

Why choose wonga loans

Wonga loans have the following advantages over other credit providers;

- Applying and receiving Wonga loans is all done online.

- Wonga is trustworthy and regulated by the National Credit Act.

- They offer excellent customer service, including a hotline you can call if you see anything suspicious.

- Wonga allows you to earn more trust and increase your borrowing amount as you continue to work with them.

- The company is a popular and registered credit provider. It offers fast responses and easy-to-use services, making it highly recommended.

- When faced with an unexpected financial crisis, Wonga offers a quick, easy solution.

- Wonga offers flexible repayment terms.

Wonga Contact Details

If you have any questions, please contact 0861 966 421, and a consultant will assist you Or visit www.wonga.co.za for more information about Wonga loans and how you can apply. Let Wonga help you.

Don’t hesitate to ask for help from Wonga consultants if you’re having trouble completing your Wonga loans application over the phone. They will also provide you with free financial advice.

Conclusion

In comparison to other online lenders, Wonga’s sophisticated risk and decision technology mean the application and approval process takes only minutes to complete. Additionally, they are uniquely flexible and can help applicants borrow the amount of cash they need and for the number of days needed.