Credit rating is very crucial because it can affect your business, employment, and loan application. Being listed on the CRB (Credit Reference Bureau) puts a mark on your credit score. However, It is possible to improve your credit rating when you know the criteria used in measuring and determining your rating.

The CRB carries out measurements on how compliant you are at repaying your loan at the agreed time, your likelihood of default, and the quality of data you supplied to lenders.

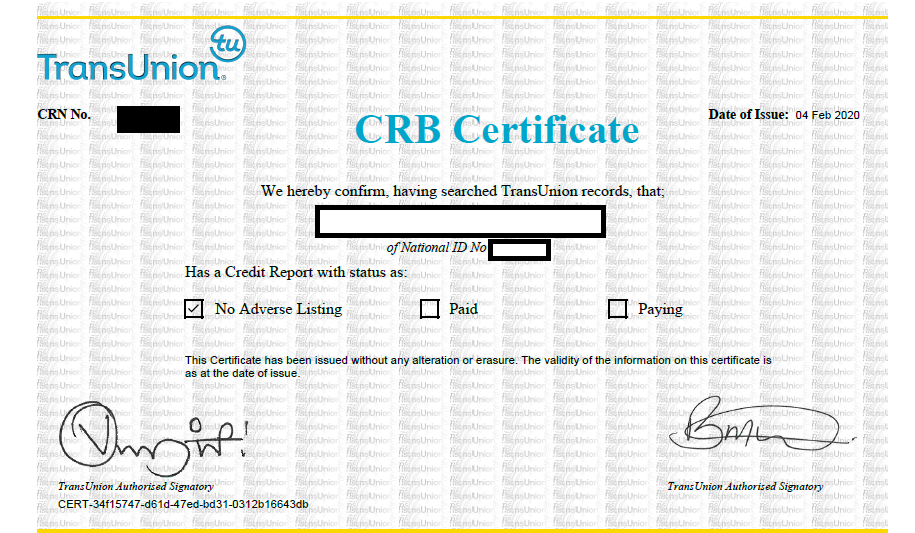

What is the CRB Clearance Certificate?

It is a document that is issued to citizens seeking to be employed, start a business, or apply for a loan. Basically, a CRB clearance certificate is issued by agencies licensed by the Central Bank of Kenya to citizens seeking their credit reports. Firms use it to note an individual’s creditworthiness.

How to get a Credit Reference Bureau Clearance Certificate

To get a CRB clearance certificate, first make an application through a licensed platform. It will cost you Ksh 2,200 for the certificate. You can get your CRB Clearance/Certificate from:

- Metropol Corporation

- TransUnion Africa

- Creditinfo Kenya

How to get your clearance certificate if you are not listed on CRB

When you are not listed, you get a clearance certificate from any Credit Reference Bureau agency. After confirming your negative reports status, you can apply for your certificate.

Licensed institutions for Credit Reference Bureau Clearance/Certificate

The Central Bank of Kenya has licensed the following CRB firms to issue clearance certificates:

- Metropol Corporation

- TransUnion Africa

- Creditinfo Kenya

You can get your CRB certificate from any of these institutions by taking the following steps

1. Metropol Corporation

- If you are using Safaricom line, dial *433# on your smartphone

- Input your National ID Number

- Type in the referred agent number if you were referred by a Metropol agent, else put zero (0) to proceed.

- Confirm and recheck all your details.

- Pay Ksh. 100 through the Paybill number 220388. The amount serves as your registration fee and use your National ID number as the account number

- You will receive an SMS bearing your Crystobol PIN. Check your message to confirm the pin

- Visit the Metropol website. On the website enter your PIN

- Choose ‘Clearance Certificate’ and pay Ksh. 2,200 for the certificate through Paybill number 220388

- Read, understand, and follow the instructions provided. From there you learn how to download your clearance certificate.

2. TransUnion Africa CRB

- Text your full names to 21272 or 21CRB. They will charge you Ksh. 19 via SMS. To save the SMS charges, the TransUnion Nipashe app.

- Pay Ksh. 50 to PayBill number 212121 and use your National ID as the account number. The amount is a one-off payment.

- Finally, pay Ksh. 2,200, then email your M-Pesa/Airtel transaction information to cert@transunion.co.ke. In return, they will email you back the clearance certificate for download.

3. Creditinfo Kenya

- Fill out the forms by following the instructions on their website.

- If you have any loan in arrears, you need to clear it to get your CRB clearance certificate. When you do not have a negative credit report, you will get a credit status certificate.

Why you need to have a CRB Clearance Certificate

They issue a clearance certificate upon request and when you have a negative listing on your credit report. It is used for various purposes and by various institutions like:

- Financial Institution

- Business

- Job application

- Tender process, etc

How long does it take to get a clearance certificate from CRB?

It takes 1 to 3 days to be cleared off from CRB when you have a positive listing and be issued a Clearance Certificate. For example, when you are listed by a lender like Branch, KCB, or Shika, it will take 1 to 3 days for the CRB to clear your name.

How much is a CRB clearance certificate?

They require it to pay Kshs. 2200 as a processing fee for a Clearance Certificate.

Note: This fee is not a fine to clear your name on CRB.

Frequently Asked Questions on Credit Reference Bureau Clearance Certificate

At what point do I need to apply for a clearance certificate?

A clearance certificate is issued upon request by an individual.

Does a clearance certificate clear individuals from their credit debt?

A Certificate is a confirmation and does not clear an individual off their credit debt. Whether you have paid for your clearance certificate or not, decisions will be made based on your credit history.

How much do I pay to get cleared with a CRB?

You do not pay the Credit Reference Bureau to get clearance. All you need is an excellent credit report. Clear all outstanding balances you have with any financial institution.

Is the Ksh. 2200 paid to the CRB as a penalty to clear your name from the CRB?

The Kshs. 2200 you pay is known as the processing fee for a Clearance Certificate. It is not a fine to clear your name on CRB.

How long is a default listing kept on CRB?

A default listing is retained on the Credit Reference Bureau for 5 years from the last date of payment.

How can I apply for a Clearance Certificate online?

Visit the website of any approved agency and apply online.

Conclusion

To get your clearance certificate, all you need is to apply with either Creditinfo, Metropol, or TransUnion. After confirming your status, you can apply for the CRB certificate.

Try as much as possible to clear all outstanding debts. A zero listing gives you your clearance certificate with less stress.