It is much easier to get loans these days than before. This is because of the continuous increase in lending institutions. Many lenders offer various loans such as; quick loans, mobile app loans, student loans, etc.

MTN QwikLoan is one of many loan options available at your fingertips. With countless lenders offering a variety of loans, it can be challenging to determine the best fit for your financial needs. This review dives into the details of MTN QwikLoan to help you decide if it’s the right choice for you.

What is MTN Qwik loan?

MTN qwik loan is the loan package MTN offers their Ghana customers. This loan package allows them to access loans through their mobile money platform. It is comparable to the MTN Ahomka loan but has its own unique qualities. Because of how much easier it is for MTN Ghana customers to access this loan, they wouldn’t need to provide proof of collateral in order to access the loan.

Once you’re in Ghana and you’re an MTN network user, you can access the cash loan. This is regardless of the time you apply for it or any purpose of the loan. Besides that, you can get this loan from any functional mobile phone.

What is the maximum loan amount I can get from MTN Qwik loan?

Before applying for the MTN qwik loan, it’s necessary to know the maximum loan amount you can get. The maximum loan amount you can get from an MTN qwik loan is GHS 1,000.

What are the requirements for MTN qwik loans?

For any financial institution to give you any form of loan. There are some requirements they expect you to meet. These requirements help them assess borrowers and also help them know which borrower should receive the loan.

The following are the requirements for MTN Qwik loans:

- You must be 18 years or above.

- If you already have a loan with the platform. You must repay it before you can get another one.

- Be a user of MTN Ghana.

- To access this loan, you must have been an MTN Ghana subscriber beyond 90 days.

- Create an account with MTN Mobile Money Services. Besides that, you must actively use it to perform some financial transactions. Transactions such as; sending and receiving money, paying of bills, purchasing airtime, etc.

How can I apply for MTN Qwik loans?

You must make the first move to get the loan you want. This is just the way it is for any form of loan application.

The following is how you can apply for an MTN Qwik loan via SMS:

- Enter *170# on your MTN mobile phone

- Select ‘5’ to access the Financial Services option

- Select ‘3’ for loan options

- Choose’1′ for a quick loan

- Then select ‘1’ for the loan request

- Thereafter choose the loan amount you want

- Then choose your repayment plan. This is the number of days it could take you to repay the loan

- After the steps above, a screen will appear whereby you will enter your secret mobile money pin. Thereafter, your loan application process is complete.

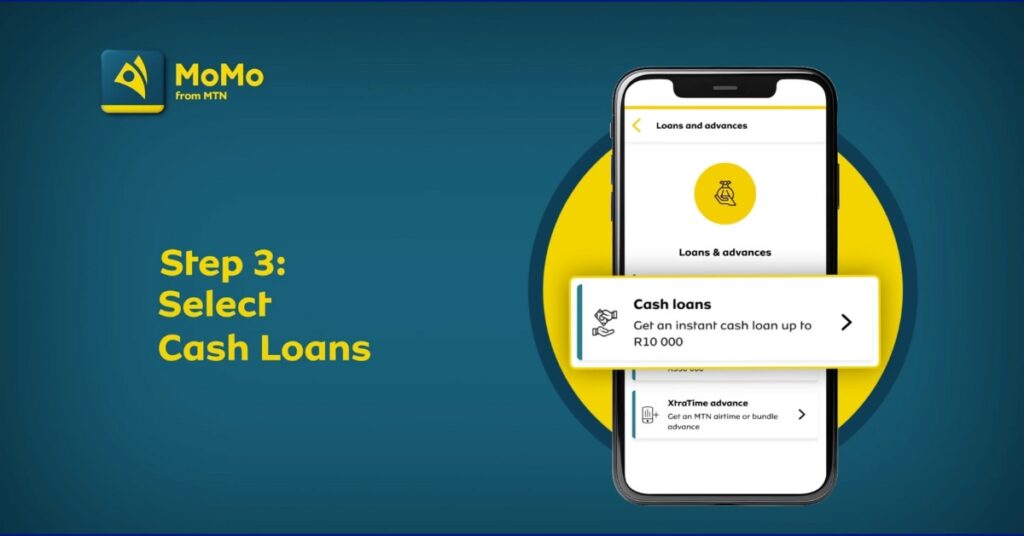

How to apply for an MTN Qwik loan via the Momo app

- Log in to the MTN MoMo app

- Select Loans

- Select Cash Loans

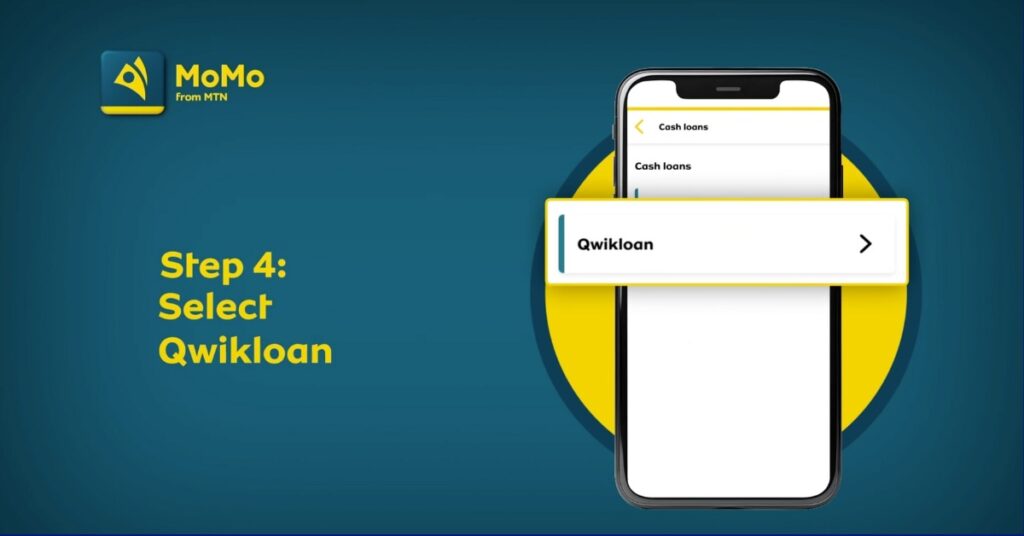

- Select Qwikloan

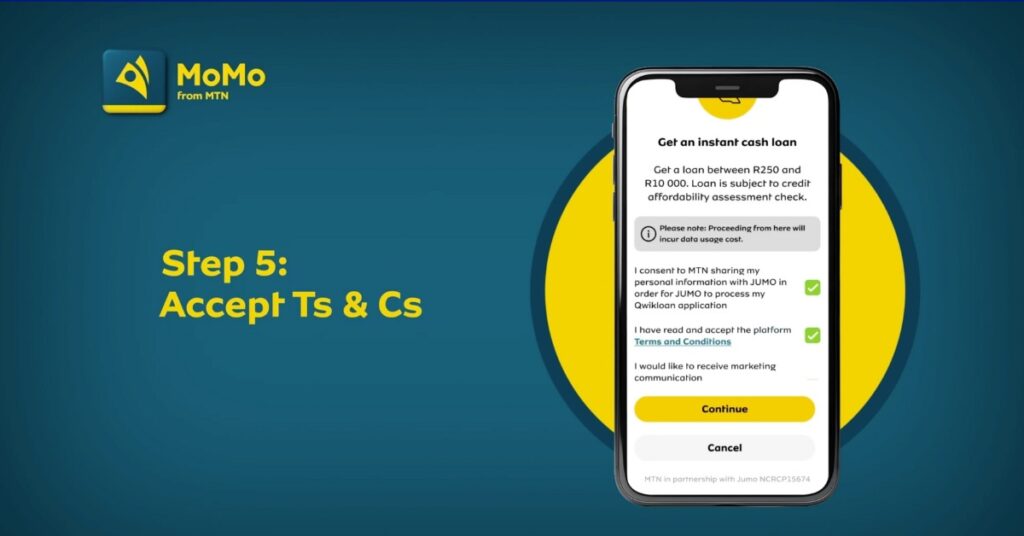

- Accept Terms and Conditions

- Check qualifying requirements

- Calculate your affordability

- Select Apply Now

- Enter your loan amount

- Review repayment terms

- Accept the loan agreement

- Application complete

You can also check out the Fido loans review.

How will I know MTN has approved my loan request?

You sure need a sigh of relief having applied for a loan. But normally, this sigh of relief comes with the confirmation that they have approved your loan request. This is not different from what is obtainable from an MTN qwik loan.

Once they approve your loan request, they will send you an SMS whereby you’ll confirm:

- The loan amount

- The repayment amount

- An interest rate of 6.9%

- The date for repayment

What is the interest rate of the MTN Qwik loan?

MTN Qwikloan is a 30-day loan with a 6.9% fee. No bank account is required. The loan is repaid in one payment by selecting the Repay loan option on the Qwikloan menu.

How can I repay my MTN Qwik loan?

You must repay every loan you owe in order to keep a good credit score. Besides that, if you cannot repay the loan you owe, you can’t get another one from MTN qwik loan.

The following is how you can repay your MTN qwik loan:

- Transfer the amount of money you have to repay into your MTN mobile money wallet before the deadline date.

- On the deadline date, they will automatically deduct the loan amount you owe from your MTN mobile money wallet.

- However, you can manually repay the loan amount you owe. You can do this by choosing the ‘Repay loan’ option on the quick menu by dialing *170#.

What is the loan duration of an MTN Qwik loan?

Every loan typically has a duration. This duration states when you have to repay the loan. The loan duration of MTN qwik loan is 30 days. If the loan is not paid after the duration it would be in default.

Conclusion

Today in Ghana, you do not need to visit any bank to access all loans. Most times, people who visit the banks do not go there for loan applications. This is because they can easily access the loans they need from the comfort of their homes. MTN qwik loan ensures that Ghanaians have easy access to loans. Besides that, they wouldn’t need collateral before they can get the loans.